Car Loans Adelaide

Author

Savvy Editorial TeamFact checked

Car loans Adelaide - lowest car finance rates in Adelaide

Car loans Adelaide way

Whether you need a car for the commute, you want a reliable new ride to get to the beach, or you just fancy a change – save money by shopping around! From those chilly South Australia Winter mornings to scorching Summer afternoons, our country throws a lot at a vehicle. There’s much to be said for trading in before a car starts to develop reliability issues. When looking for a car loan, Adelaide based motorists turn to Savvy. We’ve the widest choice of reputable lenders on the web, and we’re always seeking to save you money and time.

How Savvy makes car finance in Adelaide easy

Often, the trickiest part of making a significant purchase can be finding the best financial option out there. Doing all the research to make sure you're getting the best available deal can take a whole lot of time. That's where Savvy comes in. For years, we've been helping Australians get approved for car finance – and we do that by providing expert advice. Our friendly consultants use a wealth of experience with car loan providers so you save money. Get in touch, get the best deal, and drive your dream vehicle away sooner – for far less!

Car loans Adelaide - borrow the Savvy way

The Choices You Want, All in One Place

Helpful, Friendly Advice - Instantly

Easy, Convenient, on the Road Faster

Our range of car loan options to suit your all needs

Car finance

Chattel Mortgage

Bad credit car loans

Car lease

Novated leasing

Hire Purchase

What our customers say about their finance experience

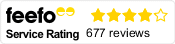

Savvy is rated 4.8 for customer satisfaction by 3362 customers.

Answers to your frequently asked questions about car loans

Lenders base car finance interest rates on a range of factors. Secured car loans from Savvy come with lower interest rates than finance agreements like personal loans where you provide no collateral to lenders. All lending is costed on the basis of risk. That means, the more security you provide, the less you’ll pay in charges. When you take out a secured car loan in Adelaide, the loan provider will check that the value of your car covers your borrowing too – to assess whether it offers adequate security. That can mean newer cars attract lower interest rates.

When comparing your car finance options, it’s a good idea not to concentrate just on the interest rates lenders advertise. They get based on an average rate and aspects like your credit rating and employment stability – even whether you own property – will also determine the final rate the lender offers. A handy tip when weighing up car finance offers is to look at the comparison rate for each loan. That figure includes any extra charges – such as regular account fees. The comparison rate displays interest charges and those fees combined, and expresses them as an overall rate. Using the comparison rate in our repayment calculator will provide a reasonably good place to begin researching the costs of different car finance deals.

You can use a range of car finance products to buy either used or new vehicles. Savvy partners with lenders who let you borrow to buy cars that can be up to 25 years old by the end of your loan agreement. That means, if you buy a vehicle using a five-year loan, it can be twenty years old at the time of purchase. Lenders may charge higher interest rates for purchasing older cars. The cheapest deals will generally get offered for cars that are new or just a couple of years old when you purchase them.

You can borrow 100% of your new car cost, or choose to use an old car as a trade-in, to reduce repayment amounts by minimising how much you borrow. Trading in your old vehicle can also save you the hassle of selling it privately. Using a cash deposit is an excellent method of bringing down the cost of borrowing, but it's by no means compulsory.

Savvy partners with specialist car loan lenders to bring you a range of flexible repayment options. In Adelaide, car loan agreements run between just twelve months and seven years. Deposits are not compulsory, and you can choose to borrow the entire cost of your new car. However, in terms of what you pay and how long for, a deposit can add some flexibility. For instance, you can use one to reduce the amount you repay on a monthly basis – or you can keep the repayment amounts but reduce the term of the loan instead. At Savvy, we have a car loan option to suit most budgets, financial goals, and circumstances.

At Savvy, we help lots of Adelaide car buyers get pre-approved for car finance – and then eventually go on to buy the vehicle they want. Getting pre-approved for a car loan in Adelaide is easy. Lenders will assess your situation and borrowing power by making a soft enquiry about your credit rating (which doesn’t show on your report) and they’ll also look at your finances, regular spending and earnings so they can let you have a ceiling amount in terms of what you can borrow. You’ll then be free to shop around – using auction sites, private, and dealership sales. Loan prea-pprovals carry no obligation to go ahead with finance.