Car Loans for Pensioners

Compare a range of competitive car loan rates for pensioners. Get approved the easy way with Savvy.

Author

Bill TsouvalasFact checked

Looking for a car loan but living on a government pension? You’ve come to the right place. Savvy works with Australians from all walks of life to help them find car finance deals to suit their needs, and those receiving pension payments are no exception.

We can help secure you a car loan by partnering with a vast range of lenders who can work with diverse income streams, including employment income, pension payments and a combination of the two. Start your application now with a quick quote and find out your car loan options today with Savvy!

What are pensioner car loans and how do they work?

A pensioner car loan is simply a car loan product taken out by someone who receives a pension or benefits from Centrelink. It’s designed to help you purchase a vehicle which, in most cases, acts as collateral for your loan.

You’ll repay your loan over a specified period, which can range from one to seven years (depending on your profile and the lender you choose), with interest and fees. In this respect, it’s no different from any other car loan.

All applicants will be required to meet their lender’s eligibility criteria before being approved. Even if you receive government benefits, such as a pension, you can still get the green light for your car loan with many lenders.

How do I qualify for a pensioner car loan?

The specific eligibility criteria for car loans will vary depending on your lender. However, the main points to consider include the following:

- You must be at least 18 years old

- You must be an Australian citizen or permanent resident (some options exist for temporary visa holders, but pensions generally aren’t open to these individuals)

- You must be earning a consistent income from one or more sources which is enough to support your repayments and meets your lender’s minimum threshold (which may be around $20,000 to $26,000)

- You must meet your lender’s credit score requirements (if applicable)

- You must be able to supply all documents requested by your lender

Another key requirement is that your pension or Centrelink benefit is accepted as income by your lender. Once again, different lenders will have different requirements in this area, but the benefits that may be accepted include:

- Aged pension

- Veterans’ pension

- Disability support pension

- Carers payment

- Single parent payment

- Family Tax Benefit A or B

Will I be able to get a car loan if a Centrelink pension is my only source of income?

You may be able to take out a car loan with 100% of your income coming from Centrelink. However, many lenders won’t accept this and will require you to be earning at least 50% of your income from other, non-Centrelink sources. You can speak with your Savvy consultant about what your options are if your pension is your only source of income.

What types of loan can I choose from as a pensioner?

There are two main types of loan on offer:

- Secured loans: these use the value of the car as collateral against the loan. This means the car could be repossessed if you default on the repayments. Secured loans are available for cars that meet your lender’s criteria relating to age and condition.

- Unsecured loans: these don’t have any asset to back them up and so usually come with higher interest rates than secured loans. These loans are generally recommended for cars that don’t meet your lender’s vehicle requirements.

These loans will either come with fixed or variable interest. Fixed rates are locked in at the start of your loan, adding stability to your repayments and protecting you against rate rises. Variable rates remain open to market fluctuation, meaning you can benefit from rate decreases, and may provide greater flexibility to pay your loan off sooner without being charged fees.

How much can I borrow for my car loan as a pensioner?

The amount you’re able to borrow will be determined by several key factors, including the following:

- Your income and expenses: the more income you have available, the more you’ll be able to afford.

- Your credit score: borrowers who have bad credit or have other blemishes on their credit file may not be approved for as great a sum.

- Your car’s value: secured car loan amounts are tied to the purchase price of the vehicle, so this will also give an indication of the amount you’ll be able to borrow.

- Your lender’s requirements: the way your application is assessed will be different with each lender. Some may be more willing to approve a larger amount than others, for instance.

Your Savvy consultant will take your initial quote and run an affordability check based on the amount you’re looking for and your desired loan term compared with your income to determine whether you can afford to comfortably manage repayments. We’ll help you proceed with your application if you can reasonably afford it but, if not, we’ll come back to you and let you know what sum you may be approved for.

How much will my pensioner car loan cost?

The cost of your car loan will depend on a range of variables, such as:

- Your interest rate and fees: the rate set on your loan will be a significant cost factor, as will the establishment, ongoing and early repayment fees (if applicable).

- Your loan term: the shorter your loan term, the less interest you’ll pay overall.

- Your loan amount: larger sums will attract more interest, so paying a deposit (if you’re able to) can save you on your loan.

- Your repayment frequency: if you decide to make additional repayments, you can pay off your loan earlier and save on interest as a result (though some lenders will charge early break fees for this).

- Whether you add a balloon payment: a balloon or residual payment will help decrease your ongoing costs, but the interest you’ll pay will be higher.

Even a small deposit or rate discount can help you save a significant amount. For example, let’s say you took out a $20,000 loan with a 5.00% p.a. interest rate over five years. If you have a 5% deposit ($1,000) you could save $132.27 over the loan term, 10% ($2,000) would save you $264.55 and 20% ($4,000) would save you $529.10.

Why you can trust Savvy’s car loan service

Access to flexible lenders

We partner with specialised lenders who are dedicated to working with customers receiving a pension, maximising your approval chances.

No application is too difficult

It doesn’t matter who or where you are across Australia: we treat every application as an opportunity to help you access much-needed financing.

Expert brokers

Our experienced loan brokers are here to walk you through the application process from start to finish and find suitable lenders and offers for your situation.

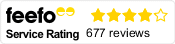

What our customers say about their finance experience

Savvy is rated 4.9 for customer satisfaction by 3947 customers.

Your questions about car loans on pension payments

No. Unemployment benefits like JobSeeker or NewStart are meant to be temporary until a recipient finds a job. A pension is a fixed ongoing income. This can be derived from the Commonwealth aged pension, disability (NDIS) pension, carer pension, superannuation income, investment income, or reverse mortgage income.

It is possible to get a loan even with a poor credit score. It might mean you have to pay higher interest though. Our loan consultants at Savvy can help you access a car loan even with bad credit.

You may be able to get a car loan for a used car. However, if the car is older than 20 years, you may have to settle for an unsecured personal loan, which will likely come with higher interest.

Car loan pre-approval is an “in-principle” agreement with a lender. The lender conditionally agrees to lend you a certain amount of money beforehand. This means you have a better idea of how much you will have to spend on a car before you go car shopping. Pre-approval is a great bargaining tool when negotiating the price of your car, as it gives your seller a clear idea of your maximum budget.

A car loan calculator is a great tool for this. You can use Savvy’s tool to enter different scenarios regarding loan amounts and interest rates to get an instant result.

This can vary, but you can get a result on your application within 24-48 hours.

You must contact your lender as soon as possible to request a hardship variation or alternate arrangements for loan repayments.

You’ll be required to submit a series of documents with your formal application, which we review and submit to the lender on your behalf.

- You’ll need to show us your driver’s licence, front and back, but failing that you can submit your passport instead.

- You’ll have to submit your last two payslips if you’re working in addition to receiving a pension, as well as your Centrelink statements from the myGov website.

- You may also have to supply 90 days’ worth of bank statements.

- Additionally, you’ll submit an application form, signed consent form and credit guide, all obtained through Savvy.

If you feel you may have trouble getting approved for a car loan on a pension, you may be able to ask your spouse, child or close family member to become your co-signer to increase your chances of loan approval. A co-signer is essentially a second applicant for the loan. Whoever agrees to co-sign your loan takes on equal responsibility for the loan in the event you cannot pay.

Ideally, your co-signer is someone with excellent credit and finances – in effect, you piggyback onto their good finances to get approved. However, they’re on the hook if you fail to repay your loan, so make sure everyone knows what they’re liable for.

Some people believe that having a low or fixed income means they “automatically” have a bad credit score. Having one doesn’t necessarily mean the other. Someone with a high income can have a terrible credit score; it all depends on the historical data to do with credit. How many loans you’ve applied for, if you’ve been rejected, whether your credit card is maxed out and defaults (failure to pay loans) are all factors.

People with low income or on pensions may only use credit cards in an emergency and have their mortgage paid off, both of which can be beneficial for your credit score. The only way to know for sure is to check your credit score for free with a credit reporting bureau.

Brands you can trust