Small Loans Up To $5,000

Need a small loan to tide you over? Savvy has you covered.

- Borrow up to $5,000

- Outcome in 60 seconds

- Flexible repayments

- 100% online

Borrow Up To $5,000

Once your application is approved, you can have your money sent within one hour and potentially arrive on the same day you apply.

Outcome in 60 Seconds

When you apply for a small loan through Savvy, you can receive an immediate outcome just 60 seconds after you submit it.

Trusted lenders

With reputable lenders behind us, you can have greater peace of mind that your money is coming from a lender you can trust.

Get the cash you need fast with Savvy

Borrow from $2,050 to $5,000

From as little as $2,050 all the way up to $5,000, your instant cash loan can be used to pay for a wide variety of expenses.

Select your repayment term

As part of your small loan, you can also choose repayment terms from 16 days up to a maximum of two years.

Diverse income streams

You can apply for your small loan with a range of acceptable incomes: full-time, part-time, casual, self-employed, Centrelink or a combination or one or more.

Set repayments

Because of the fixed nature of small loans’ added fees, your instalments will remain consistent throughout your term.

Direct transfer into your account

Not only will you fast approval on a small loan, you’ll also be able to access it from your account as soon as it’s transferred.

No hidden fees

Because all of your fees are fixed, capped and outlined in your loan agreement, there won’t be any unwelcome surprises for you.

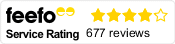

What our customers say about their finance experience

Savvy is rated 4.9 for customer satisfaction by 4098 customers.

Apply quickly, easily and 100% online

Complete your online application

Complete our application form, including your name, contact details and the loan amount you need.

Receive an instant outcome

After you submit your application, you should receive an instant outcome in 60 seconds based on the information provided.

Get funds into your account

Once approved, your lender will send the loan documents for you to sign. Your funds could be transferred in just 60 minutes and arrive in your account within 24 hours (depending on your bank).

Small loan eligibility

Over 18 years

All applicants must be at least 18 years old to qualify for a small loan, which is the case with other loan types.

Mobile & email contact

You'll have to provide contact information in your application, including your mobile number and email address.

Australian resident or working visa

You can apply for a small loan if you're a permanent resident or here on an eligible working visa.

Regular income with validated bank account

To show that you'll be able to pay off your loan, lenders require applicants to show a regular income into a validated bank account.

Common small loan questions answered

The amount you can borrow on a small loan depends largely on your individual financial circumstances. The specific loan amount you’re approved for will depend on factors like your income, credit history and employment stability. However, the actual amounts range from $2,050 to $5,000.

You can essentially use a small loan for whatever purpose you like. While they’re typically intended for short-term, urgent financial needs, they can be used for various purposes, such as covering expenses like medical bills, car repairs or utility bills, covering parts of your next holiday or even birthday or Christmas shopping.

Yes – small loans come without early repayment fees, meaning you can pay it off as quickly as you like (at a minimum of 16 days). For instance, if you took out a small loan over 12 months and received a windfall, you could pay it out after just two months and save significantly on monthly fees.

Yes – you can still be eligible for a small loan even if you have bad credit. Payday lenders consider factors beyond your credit score when assessing your application, focusing more on your income and ability to repay the loan. However, whether you can be approved will ultimately come down to your lender’s eligibility criteria.

Yes – being a single parent doesn’t disqualify you from obtaining a small loan. As long as you can show that you’re able to manage your loan’s repayments, you can be approved as a single parent.

Whether your loan can be paid out on the weekend will depend on your lender’s business hours. Some may be open on Saturdays, meaning they may be able to send it on the weekend, but if they’re only open on weekdays, you won’t be able to receive your funds if you apply on Saturday or Sunday.

Apply for your cash loan and borrow up to $5,000 with Savvy

By completing our simple online application, you can have the cash you need on the way before you know it!

Disclaimer:

The information on this website is of general nature and does not take into consideration your objectives, financial situation or needs.

For loans between $2,050 and $5,000, the APR is between 21.24% (minimum) and 48% (maximum) per annum. Comparison rate of 65.4962%. Minimum term is 16 days and maximum term is 24 months. The cost of the loan is a $400 establishment fee and monthly interest charged on the amount borrowed. For example, a loan of $3,000 over 3 months with an APR of 48%, (comparison rate of 65.4962%), will have an establishment fee of $400, monthly repayments of $1,225.20. Total repayments of $3,675.60 and total interest payment of $275.60.

Warning: A comparison rate indicates the true cost of a loan. Comparison rates are true only for the examples provided and may not include all fees and charges. Different terms, fees or loan amounts might result in a different comparison rate.

© Copyright 2023 Quantum Savvy Pty Ltd T/as Savvy. All Rights Reserved. ABN 78 660 493 194. ACR Number 541 339. Free Phone: 1300 974 066.