Home > Health Insurance > How Much Is Private Health Insurance?

How Much Is Private Health Insurance?

Discover how much private health insurance costs in Australia here with Savvy.

Author

Savvy Editorial TeamFact checked

The cost of private health insurance in Australia will vary depending on several factors, including the type of health insurance you buy and the level of policy you choose. By comparing your health insurance options thoroughly, you’ll increase your chances of finding a policy which provides the type and level of cover you need at an affordable price.

Savvy can help you understand what factors affect the cost of your health insurance, and then help you get free quotes for the type of cover you require. Through us you’ll be able to compare offers from a panel of respected Australian insurers and receive instant online quotes. Start the process with Savvy today.

How much do private health insurance policies cost?

Types of private health insurance available

There are several different types of health insurance plans available in Australia, including:

- Hospital cover: this can cover inpatient hospital treatments like surgeries and overnight stays. The cost of hospital cover depends on the tier of cover you choose to buy, ranging from basic policies up to the most expensive tier, gold cover.

- Extras cover: this type of health insurance covers services like dental, optical and physiotherapy. The cost of such policies depends on factors such as the services covered, the level of coverage you choose and policy benefit limits.

- Combined hospital and extras cover: as the name suggests, this plan combines both hospital and extras cover and can provide coverage for both inpatient hospital and general outpatient treatments.

- Ambulance cover: this insurance can offer cover for the cost of being transported to hospital, either by road or by air.

Cost of hospital cover

The cost of a hospital cover policy will depend on two basic factors:

- the tier or level of cover you buy

- the excess amount you choose

Tiers of cover

Hospital insurance is strictly regulated by the Australian Government. All tiers or levels of hospital cover must by law offer coverage for a set number of clinical categories.

There are four tiers of hospital insurance available, with the level of cover offered increasing as the cost of the policy rises. These are:

- Basic – offers cover only for limited treatments, such as psychiatric services, palliative care and rehabilitation

- Bronze – offers all the above cover, plus cover for an additional 18 clinical categories

- Silver – offers cover for up to 29 further clinical categories

- Gold – offers top-level cover for all listed clinical categories

If you choose a basic hospital cover policy, you’ll only be insured for treatment for the three clinical categories mentioned above, but will likely pay the least for your insurance. While a gold policy is typically the most expensive health insurance plan, it’ll cover you for all clinical categories of treatment you could receive as a private patient in hospital.

Excess amount

Hospital cover policies may require you to pay an excess when making a claim, which you can generally select yourself. An excess is a set amount you contribute towards the cost of your claim. These may range from zero to $250, $500 or $750. However, choosing a lower excess will generally result in higher premiums.

Examples of the cost of hospital cover*

These costs are based on hospital cover prices from selected providers for a customer in Victoria, earning under $90,000 p.a. with a $750 excess.

Examples of the cost of extras cover*

Extras policies have less defined coverage levels, with more expensive comprehensive policies typically offering higher claimable limits and more included services. The following prices are again based on a customer in Victoria:

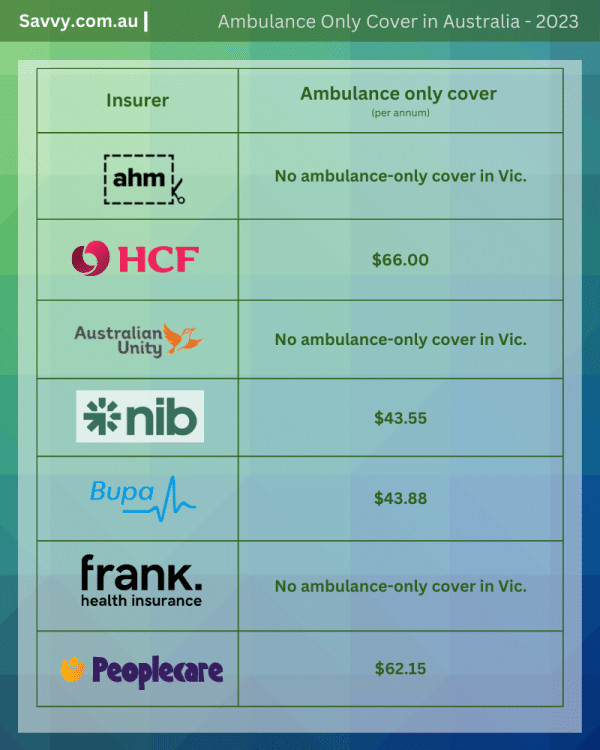

Examples of the cost of ambulance cover*

Ambulance cover is frequently provided free with either a hospital or extras policy, particularly if you buy a higher-level hospital policy or a combined policy. However, these are some examples of the cost of ambulance cover from selected insurers who do offer standalone ambulance cover:

Average cost of combined policies*

Combined hospital and extras policies are available from many health funds. They are also available in different levels of cover, ranging from cheap policies offering a low level of cover, to more expensive ones offering a higher level of cover.

They can either offer a basic or bronze level of hospital cover with a similar cheap extras policy, or a silver plus or gold hospital policy and a higher-level extras policy to match.

* All costs current as of May 2023, but subject to change

What other factors can affect the cost of my health insurance?

There are several other factors which can influence the cost of your private health insurance in addition to the level of cover you choose to buy. These include:

Private Health Insurance Rebate

The Australian Government offers assistance with the cost of health insurance through the Private Health Insurance Rebate, which is based on your income and age. Older Australians and those earning less than $90,000 per year receive more assistance. As of April 2023 the rebate ranges from 8.2% up to a maximum of 32.8% depending on your age and income. It’s possible either to claim the rebate back on your tax return once a year, or to claim it from your health insurance company in the form of reduced monthly premiums.

Medicare Levy

All taxpayers are required to pay the Medicare Levy, which is a 2% tax on income which funds the Medicare system. However, depending on your age and income, you may be entitled to an exemption from paying the Levy.

Lifetime Health Cover loading

Lifetime Health Cover (LHC) loading is an additional loading you’ll have to pay on the price of your health insurance premiums if you don’t have private health insurance once you turn 31. It is an additional 2% on top of the standard cost of health insurance for each year you are aged over 30 and didn’t have health insurance on the 1st July in the year you turned 31. It is capped at a maximum of 70%, and applies for a total of ten years.

Age-based discounts

Younger Australians aged 18 to 29 years may be eligible for an age-based discount. This discount can be 2% for each year you are aged under 30, capped at a maximum of 10% for those aged 18 to 25 years. The discount doesn't apply to people who are covered as a dependent on a family or single parent policy.

Frequently asked questions about the cost of private health insurance

Yes – in Australia, private health insurance premiums can vary depending on the state or territory you live in, as well as the specific area within that state or territory. This is because the cost of healthcare services and hospital treatments can vary between different states and regions.

Many health funds offer discounts on premiums if they’re paid annually, or sometimes even if they’re paid by direct debit. This discount varies between health funds, but is often in the region of 2% to 5% for annual pre-payment.

No – all health insurance policies sold in Australia are subject to community rating, which means that everyone pays the same for their health insurance regardless of any pre-existing medical conditions. It’s illegal to discriminate against anyone based on their age, gender, health status or claims history, and it is not legal to refuse to insure someone based on their medical history.

You can choose to have either hospital cover, extras cover, or both, depending on your budget, health needs and preferences. However, it's important to note that if you only have extras cover without hospital cover, you may still be subject to paying the Medicare Levy Surcharge if your income exceeds the income threshold set by the government, which in April 2023 was $90,000 p.a. This is an additional health care tax paid by those on higher incomes who don’t take out private health insurance by the age of 31, and may cost up to 1.5% of your salary.

Helpful health insurance guides

Compare health insurance policies online

Disclaimer:

Savvy is partnered with Compare Club Australia Pty Ltd (AFS representative number 001279036) of Alternative Media Pty Ltd (AFS License number 486326) to provide readers with a variety of health insurance policies to compare. Savvy earns a commission from Compare Club each time a customer buys a health insurance policy via our website. We don’t arrange for products to be purchased from these brands directly, as all purchases are conducted via Compare Club.

Savvy’s comparison service is provided by Compare Club. Compare Club compares selected products from a panel of trusted insurers and does not compare all products in the market.

Any advice presented above or on other pages is general in nature and doesn’t consider your personal or business objectives, needs or finances. It’s always important to consider whether advice is suitable for you before purchasing an insurance policy.

For any further information on the variety of insurers compared by Compare Club or how their business works, you can read their Financial Services Guide.