- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

In this article

With the End of Financial Year (EOFY) approaching and cryptocurrency holders wincing at the recent crash across the major coins, Australians new to the world of cryptocurrency may be wondering what their tax obligations are. In this report, Savvy examines the data to provide insight into the crypto tax situation in Australia.

- 50% Capital Gains Tax exemption on crypto profits if held for at least a year

- Crypto is tax-free if used for personal purchases or donations

Crypto will be taxed when swapped, spent, or gifted - 70% of Aussies buy crypto to build wealth, 34% to retire early, 28% for portfolio diversification

The landscape of cryptocurrency in Australia

Cryptocurrency started life in 2009 with the launch of the Bitcoin network, which envisioned a peer-to-peer, decentralised value network based on computers solving cryptographic puzzles (where the “crypto” comes from.)

Fast-forward to today, and Bitcoin plus many other cryptocurrencies such as Ethereum, Litecoin, Ripple, and even “joke” coins such as Dogecoin are regularly traded back and forth between users all over the world. Many businesses now accept cryptocurrency as a form of payment.

The biggest demographic holding crypto are men (77%) between the ages of 25 and 44 (69%) with the next highest demographic being 44-59 year olds (18%).

According to the BTC Markets Investor Study (FY2020-21) there was a 175% increase in the number of trades in Bitcoin, with a 31% year on year volume growth. The biggest demographic holding crypto are men (77%), with the dominant age group of 25 and 44 (69%). The next highest demographic being 44-59 year-olds (18%).

By the release of the April 2022 report, it was found that the 45-59-year-old age group had experienced the largest growth, year-on-year – some 79%!

In Savvy's 2021 representative survey of 1000 Australians, it was found that 17.3% of Australians already owned some form of cryptocurrency.

In 2021, the investor groups seen to have grown the fastest were sole traders (196%), companies (79%), Self-Managed Super Funds or SMSFs (74%) and individuals at 66%.

70% of investors say that they wish to build wealth; 34% say they want to retire early, and 28% say they want to diversify their portfolio.

No matter what reason people hold crypto, they will be liable to pay tax on it.

There is a common misconception that cryptocurrency is “untraceable” or “flies under the radar” of authorities.

In theory, this is correct – but ongoing integration into the broader financial system means crypto exchanges have been brought under tighter oversight and regulation by government, and Australia is no exception.

Isn’t cryptocurrency untraceable?

In theory, two transactions between two individual crypto wallets are untraceable – unless you can reveal the identity of the wallet holders. For most crypto holders, they usually convert their fiat currency (or normal money) into crypto by way of an exchange.

In order for major crypto exchanges to trade financial instruments in Australia, they must be regulated by the Australian Securities and Investments Commission and/or the Australian Prudential Regulatory Authority. These exchanges are then made Designated Service Providers (DSPs.)

If you have ever signed up for an exchange, you will know that they ask for a lot of personal data, known as Know Your Customer (KYC) data. This may include up to 100 points of government issued ID, a current photo to check against your ID as fraud prevention, your bank account details, and in some cases, your ABN if you run a business.

If you use a DSP in Australia, it’s highly likely the ATO has all your KYC and transactional data already – as far back as 2014, in fact.

All Australian-operating exchanges share data with the ATO as part of their regulatory framework. In 2020 and 2021, hundreds of thousands of Australian crypto holders received a letter warning that any failure to declare their crypto holdings would result in charges of tax evasion. The ATO will likely send out similar letters during tax time this year.

Is cryptocurrency taxed in Australia?

Yes – the ATO taxes cryptocurrency transactions in Australia. Disposal of cryptocurrency is known as a Capital Gains Tax event in Australian tax law. If you make a capital gain (make money) on your cryptocurrency disposal, some or all of the gain may be taxed.

You’ll also pay tax when you:

- Swap one crypto for another

- Spend crypto to buy goods or services (if not for personal use – and does not include GST)

- or give crypto away as a gift.

The ATO also taxes airdrops (gifting of NFTs or crypto from an external source), forgers (people who hold crypto in a sort of escrow to validate transactions and create new blocks in the chain) and any mechanism that generates additional tokens such as staking. Staking is common among cryptocurrency exchanges and is also a value-add tactic among some NFT projects.

Tax free crypto transactions

You can buy up to $10,000 worth of crypto to directly purchase goods or services with that crypto – and you will be eligible for a CGT exemption. For example, buying $50 of crypto each month for an online game subscription service that only accepts crypto would be considered a personal use case, and exempt from any taxes (except the Commonwealth GST, which is collected on low value goods in some cases.)

Donating crypto to registered charities are also tax deductible.

Bill Tsouvalas, Savvy Managing Director & personal finance expert;

“Many everyday investors have been caught up in the hype of the crypto-currency craze and are guilty of shiny object syndrome.. wanting to jump on board with the latest trend and hopefully ride the wave to easy wealth. Recent events have shown the risks involved with this kind of speculation however. For people who have borrowed money to invest, or have placed large amounts of savings in crypto – hard times may be ahead. The takeaway now is to only invest as much as you can afford to lose.”

For Aussies who have made money on their investments, their best bet is to be up front with the tax office. You don't want a big tax debt rearing its ugly head somewhere down the track."

What about NFTs?

Non-Fungible Tokens (NFTs) have become popular in recent times and are considered digital assets – the same class of property as shares, property, and of course, crypto.

For example, the Dreadfulz NFT allows Dreadfulz NFT holders to stake their NFT in exchange for accruing the $DREAD token, a derivative of Ethereum. The $DREAD token is the currency in use as part of the Dreadfulz Decentralised Autonomous Organisation (DAO).

A DAO is a leaderless “mutual fund” that allows stakeholders to vote on how funds in the DAO are invested, distributed, or divested. Further tokens may be issued if a stakeholder “burns” (liquidates) their NFT for other tokens.

Though not expressly written in the ATO documentation, this could also extend to gains from NFT led DAOs, especially if the staked coins are then exchanged at a DSP and back into fiat currency.

Crypto investors vs. traders – is there a difference?

Yes – the main difference being the 50% Capital Gains Tax discount. Long-term investors can access this discount if they hold their crypto for at least one year before disposal.

Therefore, if Investor A buys $10,000 of crypto, holds it for over a year and makes $5,000 in profit, they will only have to declare a capital gain of $2,500.

Traders who frequently buy and sell their crypto to take advantage of market fluctuations as part of a business – and this can include forging, staking, or mining – you will be taxed as a trader. If you operate your trading like a business, i.e., try to earn income from your trading, your proceeds will be considered taxable income.

How to calculate crypto Capital Gains Tax

You can make a detailed calculation of any capital gains tax using the ATO website, provided you have a current and active MyGov account.

You will need to know your pre-tax cost-basis for acquiring the crypto first. That means, if you bought $500 worth of crypto and paid a $50 fee, the cost basis is $550.

Now let’s say you dispose of that crypto when it reached $1,000 and paid an additional $50 fee to convert the crypto into fiat – the cost basis is now $600 (the initial $550 plus $50) which means the total gains are ($1,000 – $600) = $400.

If you kept the crypto for at least a year before cashing it out, your gain would be eligible for the 50% discount – which means the ATO would only tax $200.

This is all well below the tax-free threshold, but it still must be declared in your tax return as capital gains.

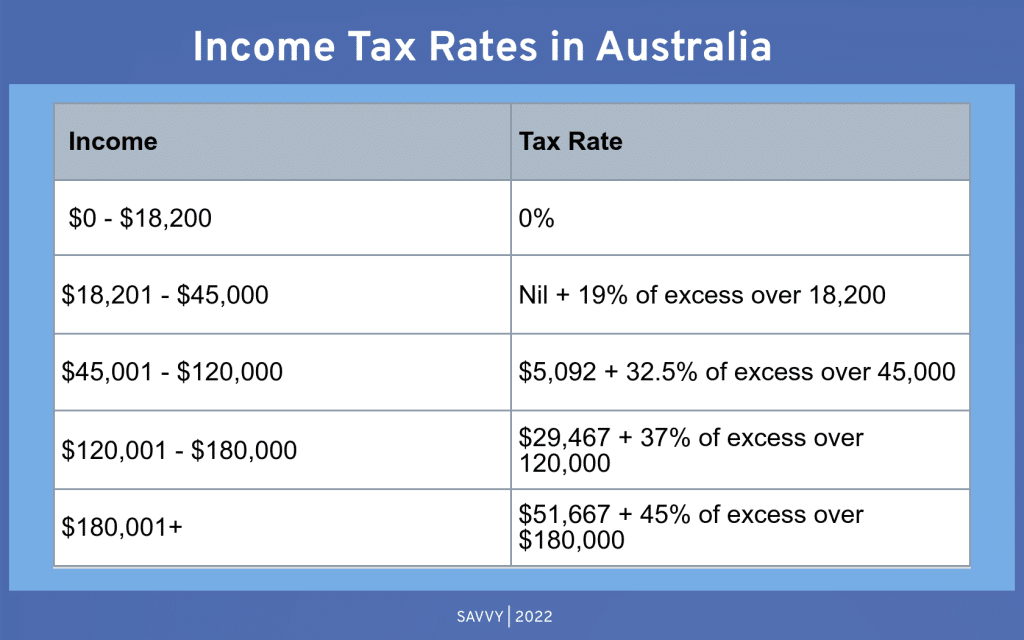

For a decent “back of the envelope” calculation, you can make a rough estimate by looking at the income tax rate. The current income tax rate (without including the Medicare Levy of 2%)

www.ato.gov.au

Can you use software to help calculate crypto taxes?

Yes, there exists many accounting software packages that can help you calculate your tax liabilities. Some of the more popular packages are Crypto.com tax, which integrates with popular exchanges and wallets to help classify transactions as gifts, airdrops, trades, and etc.

Koinly is an online crypt tax service platform that can monitor all your transactions and generate regulatory tax reports for you or your accountant. It also updates your reports with current prices, so you are getting the most up-to-date cost basis information.

Other tax packages are Taxbit, which was developed by leading blockchain Certified Practicing Accountants and tax lawyers in Australia and gives you options to exchange crypto – and even keep up with US tax obligations. This is expensive, though geared toward sophisticated investors or businesses.

Accointing is a minimalist package that gives crypto traders and enthusiasts all the tools they need to keep up with their tax obligations.

Other popular online accounting packages such as Xero can be used to track crypto transactions, though it’s not fully integrated into the system; though you can hack together some finnicky workarounds.

Self-Managed Super Funds and Companies that hold crypto

Self-Managed Superannuation Funds or trust companies that hold crypto, after a review by the trustees has deemed it to be acceptable, will also have to be mindful that buying and selling cryptocurrency will attract capital gains tax.

Superannuation laws also require trustees and members to ensure their fund’s assets are held separately from their personal or business assets, and that the SMSF entity has clear ownership of the crypto, not the trustee or member.

There are many other restrictions and caveats on investing in crypto within a SMSF, including the ‘sole purpose test’, which states that a SMSF only holds crypto for the express purpose of benefiting the members or trustees of the SMSF in retirement.

Why Australians aren’t fully embracing crypto – yet

Cryptocurrency, despite seeming stable, is a relatively volatile market to invest in. In May this year, Bitcoin prices plunged 20% – nearly 60% lower than its all-time high in November 2021. Other popular cryptos such as Ethereum and Solana are also worth fractions of their all-time highs. One coin, Terra Luna, lost 99% of its value in one week, causing many to lose their entire savings.

The BTC Markets Investor Study Report showed that 49% of respondents said that market volatility was the biggest challenge for investing in crypto – followed by “information overload” (34%) and lack of understanding of tax obligations (32%). 23% say there is a lack of regulation in the crypto industry – what happens when an investor loses almost everything to an overnight crash?

51% also agreed that crypto investment performance would be volatile with extreme highs and lows – only 30% said it would have a steady and sustained trajectory.

As for what happens next in crypto – your guess is as good as ours.

The taxation and financial information presented here is general in nature. Consult a tax or financial professional for advice on tax obligations and financial product investments.

Did you find this page helpful?

Author

Adrian EdlingtonGuest Contributor

Bill TsouvalasPublished on May 27th, 2022

Last updated on March 18th, 2024

Fact checked

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.