Debt Consolidation Loans

A debt consolidation loan is simply a personal loan used to clear one or more outstanding debts. There are several key reasons why someone would look to consolidate their debts into a personal loan: To ensure any high-interest or overdue debts are cleared, saving you from potentially paying even more and ending up in a […]

Bad Credit Loans

Bad credit? Don’t sweat it If you’re saddled with a bad credit score, it’s important to know that you’re far from alone: hundreds of thousands of Australians find themselves in that very position. While it hasn’t always been the case, there are more specialist lending options today than ever before when it comes to financing […]

Self-Employed Home Loans

Years ago, the big banks wouldn’t lend to the self-employed, but that’s all changed now with online lenders increasing the competition in the home loan market. You can take an in-depth look at the best home loans for self-employed workers, the documentation you’ll need and all the features on offer right here with Savvy. Comparing […]

Bad Credit Home Loans

If you’ve ever been rejected for a home loan, or even fear applying for one due to your poor credit history, you’re not alone. Hundreds of thousands of Australians each year are at high risk of credit defaults. However, the good news is that a bad credit score shouldn’t prevent you from being approved for […]

Home Loan Refinance

There’s never been a better time to think about refinancing your home loan, with interest rates now on the rise and many online lenders making the home loan market highly competitive. Whatever your reason for wanting to switch to another loan there’s plenty of opportunities to save money, both on fees and interest payments. Whether […]

Investment Home Loans

Whether you’re buying an investment property for the first time or looking to add another to your portfolio, the fact is that you’re going to need finance. Find out about all the options available with Savvy and compare offers to help you find the cheapest investment loan rates with the best deal possible for your […]

First Home Buyers

Buying your first home will probably be the biggest purchase you’ve made in your life to date. Therefore, it’s important to be across as much as you possibly can regarding home loans and the numerous types of assistance offered to first home buyers. Savvy can help you with valuable home loan information and, when you’re […]

Unsecured Business Loans

Unsecured business loans are flexible loans that don’t require you to put up an asset as collateral, making them more widely available to businesses of all sizes. They’re designed to be used for a variety of different purposes, rather than buying a specific asset (like a chattel mortgage to buy a car or equipment, for […]

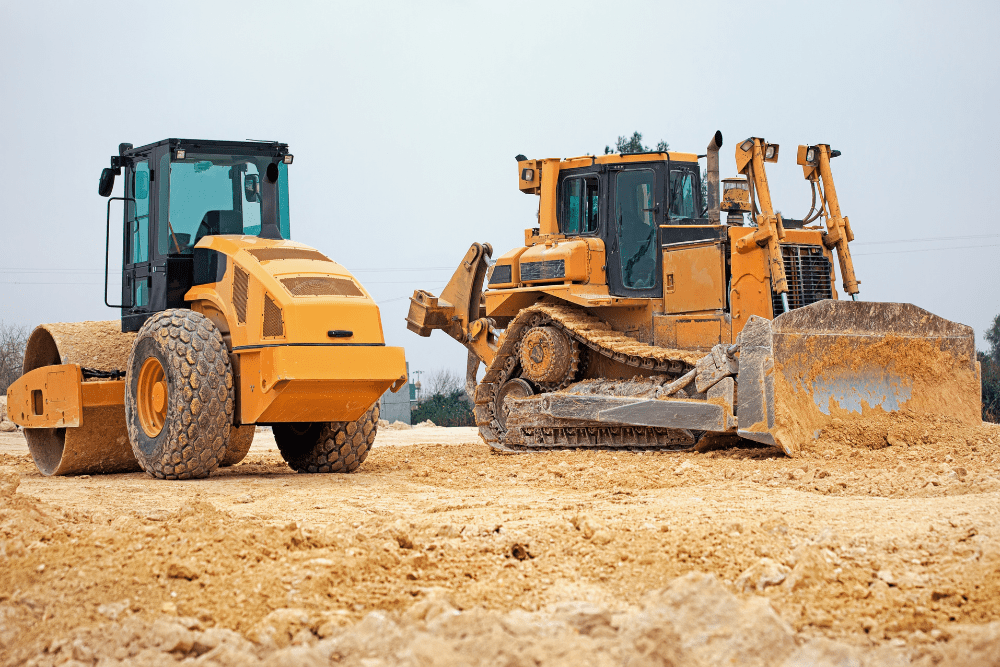

Plant and Machinery Finance

Flexible and affordable plant finance for you Whether you’re looking to buy new, refinance existing plant, or replace your old machinery or plant, Savvy has a range of commercial loan options, such as affordable and flexible chattel mortgages and commercial hire purchases. We also help your business find the best deals and lowest finance rates […]

Agriculture Finance

Flexible agricultural loans and leases tailored to you Agriculture finance is simply the blanket term for a range of different products that can help you access the assets your agribusiness needs. When it comes to financing purchases for your business through Savvy, you’ll have a few different options to choose from, all of which require […]

Truck Finance

When you’re in the business of hauling heavy-duty plant and equipment, you need a truck to match. That’s where a cashflow-positive, tax-effective truck finance deal through Savvy can help you out. Whether you’re looking to buy one for your small business or lease a fleet for your larger-scale operation, we’ll compare your options among our […]

Equipment Finance

Buying equipment for your business is a big investment. At Savvy, we offer a range of flexible and tailored commercial finance options to help you get the equipment you need, when you need it. We work with some of Australia’s top lenders to secure competitive finance deals that work for you. Get started with us […]