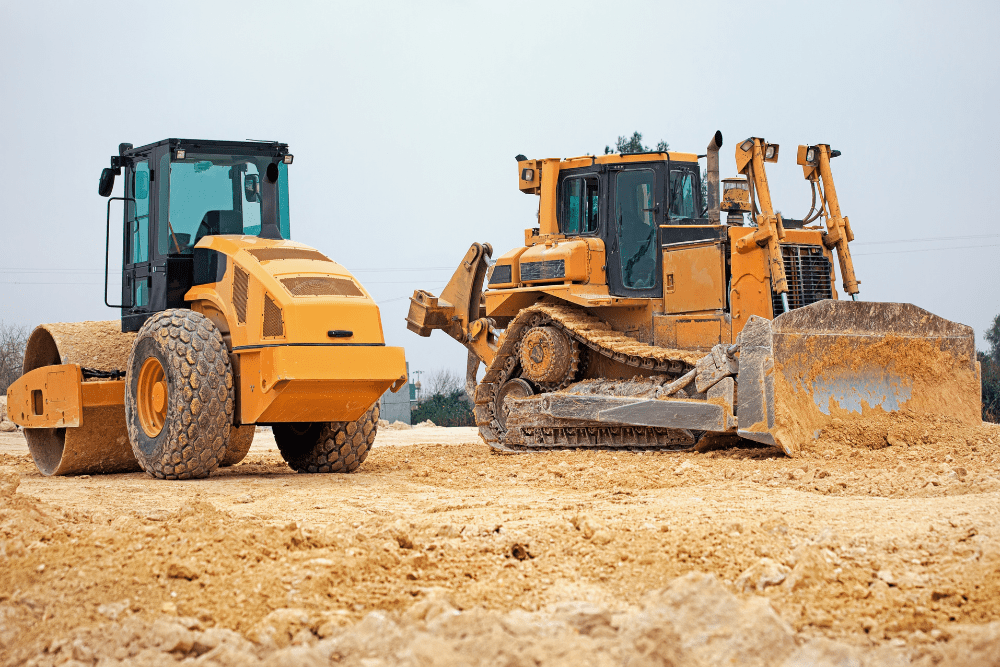

A chattel mortgage is a type of loan that allows you to purchase a commercial asset. This can include cars, commercial vehicles like vans, buses, trucks and tractors and specialised equipment, though motor vehicles are the most common use for these loans. If you're in the market for a vehicle or equipment for your business, get a free, no-obligation quote with Savvy today!

Why apply for a business loan with Savvy?

Expert brokers

You can speak with one of our specialist commercial brokers who can walk you through a range of loans to best suit your company's needs.

Over 40 lending partners

You can compare business loan offers, through a range of trusted lenders, maximising your chances of a great rate.

Fast online process

You can fill out our simple online form to generate a free business finance quote within minutes. You can also come back to it at any time.

Business lenders you can compare

How do chattel mortgages work?

Chattel mortgages work in a very similar way to a standard car loan, with several areas tailored to commercial needs. Here’s how they work:

- Buy new or used (provided it meets your lender’s criteria)

- Borrow from $5,001 to 100% of your asset’s value

- Have your loan secured by your asset (as collateral)

- Repay your loan over between one and seven years

- Make payments on a weekly, fortnightly or monthly schedule

- Repay with interest and fees (some may waive certain fees)

- Deposits and balloon/residual payments are optional

- Early repayments may be available with some lenders

What are the tax benefits of chattel mortgages?

The biggest difference between chattel mortgages and car loans is their tax benefits. Under a chattel mortgage agreement, you can claim the following:

- Interest on your loan repayments

- GST on the purchase of the asset

- Depreciation of the asset over time

It’s important to note that you’ll only be able to claim for the business portion of each of these expenses. For example, if you’re using your car for business purposes 75% of the time, you can claim up to 75% back on tax. You can only receive the full amount if your asset is used exclusively for commercial purposes.

If you’re unsure how much to claim, you should speak to your accountant or a tax professional. Every business is different, so it’s crucial to get personalised advice before you complete your tax return.

How are chattel mortgages different from leases?

There are several key differences between chattel mortgages and finance or operating leases. Let’s break it down:

| Chattel mortgage | Commercial lease | |

|---|---|---|

| Ownership? | From the start | Optional at the end of the agreement |

| Tax-deductible payments? | Interest only | Yes (subject to usage) |

| Residual included? | Optional | Mandatory |

| Options at the end of the agreement? | Whatever you like, as you’ll own the asset | Buy, sell or trade in the asset or refinance the residual to continue your lease (finance lease) Hand back the asset to your lessor (operating lease) |

| Available terms? | One to seven years | One to five years (up to seven possible if the residual is refinanced) |

| Ability to use a deposit/trade-in? | Yes | No |

How much will my chattel mortgage cost?

When it comes to the cost of your chattel mortgage, it’s important to keep a number of factors in mind. These include:

- Your interest rate: the higher your rate, the more you’ll pay. This is only relevant to note if your vehicle or asset is used partly for private purposes, as 100% business usage makes your interest entirely tax-deductible.

- Your loan fees: on top of interest, you may also be charged certain fees as part of your chattel mortgage. These can add up, especially if they’re charged on an ongoing basis. In some cases, though, these may also be partially or fully tax-deductible.

- Your loan amount: because interest is calculated based on your balance, larger loans will attract more overall.

- Your loan term: similarly, longer loan terms mean your loan balance is higher for longer, resulting in the interest you pay being higher overall.

- Your deposit: your deposit reduces the size of the loan, so paying part of the purchase price out of your savings can save you on interest.

- Whether you have a residual: although a residual payment can reduce your monthly repayments, it increases the amount of interest you’ll pay overall. This is because you’ll be paying your loan down to the residual value (such as $3,000) instead of $0, so your balance reduces more slowly.

How do I compare chattel mortgages?

We’ve discussed the key elements of chattel mortgages above, but when it comes to comparing your options, it’s essential to know what you’re looking for. The most important points of comparison between different offers are:

- Interest rates

- Fees (including the nature of the fees, such as application, ongoing or early repayment costs)

- Comparison rates (a combined rate including both interest and non-conditional fees)

- Available loan terms

- Available loan amounts (whether there are borrowing limits imposed)

- Repayment flexibility (your ability to choose your repayment schedule and pay off your loan early without fees)

- Personal and business eligibility criteria

- Asset eligibility criteria

When you apply with Savvy, however, we’ll do the hard work for you. Once we receive your application, we’ll get to work comparing options available from our vast and diverse lender panel to find the best deal available for your business.

The benefits of chattel mortgages

-

Borrow up to 100% of your asset’s price

If you don’t want to eat into your business’ cash reserves, a chattel mortgage allows you to space out the payment of your asset purchase to suit your needs, even borrowing the whole sum.

-

Own your vehicle or equipment from the start

Unlike leases, your business will own the asset from the start of your agreement, so you’ll have more freedom to use it how you like (certain modifications may not be allowed, though).

-

Choose your preferred repayment term

Loans are highly customisable, so you can select a term as short as 12 months or one as long as seven years, depending on how much you’re borrowing and your business profile.

-

Enjoy tax benefits

Perhaps the biggest advantage from a financial perspective is the ability to claim part or all of your loan’s expenses on tax, in addition to GST and depreciation.

-

Add a customisable deposit or residual

If you want to reduce the cost of monthly repayments, you can choose to pay a deposit upfront, a residual at the end of your term or both, with both fully customisable.

-

Take advantage of early repayments with certain lenders

Additionally, some lenders may allow you to make additional payments towards your loan debt without hitting you with steep fees, but this isn’t the case with many others.

Applying for a business loan

-

Review your lender’s criteria

Make sure you’re eligible to borrow. You’ll need to have been trading for at least six months, with some requiring a minimum monthly turnover of $5,000.

-

Gather your documents

Different lenders will require different documents, but you’ll need your ABN, GST, personal identification and select business financials for larger loans.

-

Apply and sign your contract

You can fill out your application form and submit it with your documents for a fast outcome and, if successful, your lender will send you a contract to sign.

-

Funds in your account

Once you’ve returned your contract, your lender can release the funds directly to your listed bank account, after which you can use them how you wish.

-

Funds in your account

Once you’ve returned your contract, your lender can release the funds directly to your listed bank account, after which you can use them how you wish.

Commercial loan eligibility and documentation

Eligibility

-

Age

You must be at least 18 years of age

-

Residency

You must be an Australian citizen or permanent resident (or, in some cases, an eligible visa holder)

-

ABN registration

Have an ABN registered in your name (available from as soon as one day after registration)

-

Usage

Meet commercial asset usage requirements (at least 51% of total usage)

-

Credit score

You must meet your lender’s minimum personal and business credit score requirements

-

Commercial asset

The asset you choose to buy must meet your lender’s requirements in relation to its type, age and condition

Documents

-

Personal information

Such as your full name, date of birth, address and contact details

-

Driver's licence

Front and back (or another form of government-issued ID)

-

Assets and liabilities

Information about your business’ assets and liabilities, as well as those in your name

-

Asset details

Information about your asset, including its model and age, is worthwhile having on hand

-

Business statements

Business Activity Statements (BAS) and business bank statements may be requested, but not always