- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.

Approval for a mobile phone plan is always subject to our lender’s terms, conditions and qualification criteria. Lenders will undertake a credit check in line with responsible lending obligations to help determine whether you’re in a position to take on the loan you’re applying for.

The interest rate, comparison rate, fees and monthly repayments will depend on factors specific to your profile, such as your financial situation, as well others, such as the loan’s size and your chosen repayment term. Costs such as broker fees, redraw fees or early repayment fees, and cost savings such as fee waivers, aren’t included in the comparison rate but may influence the cost of the loan. Different terms, fees or other loan amounts may result in a different comparison rate.

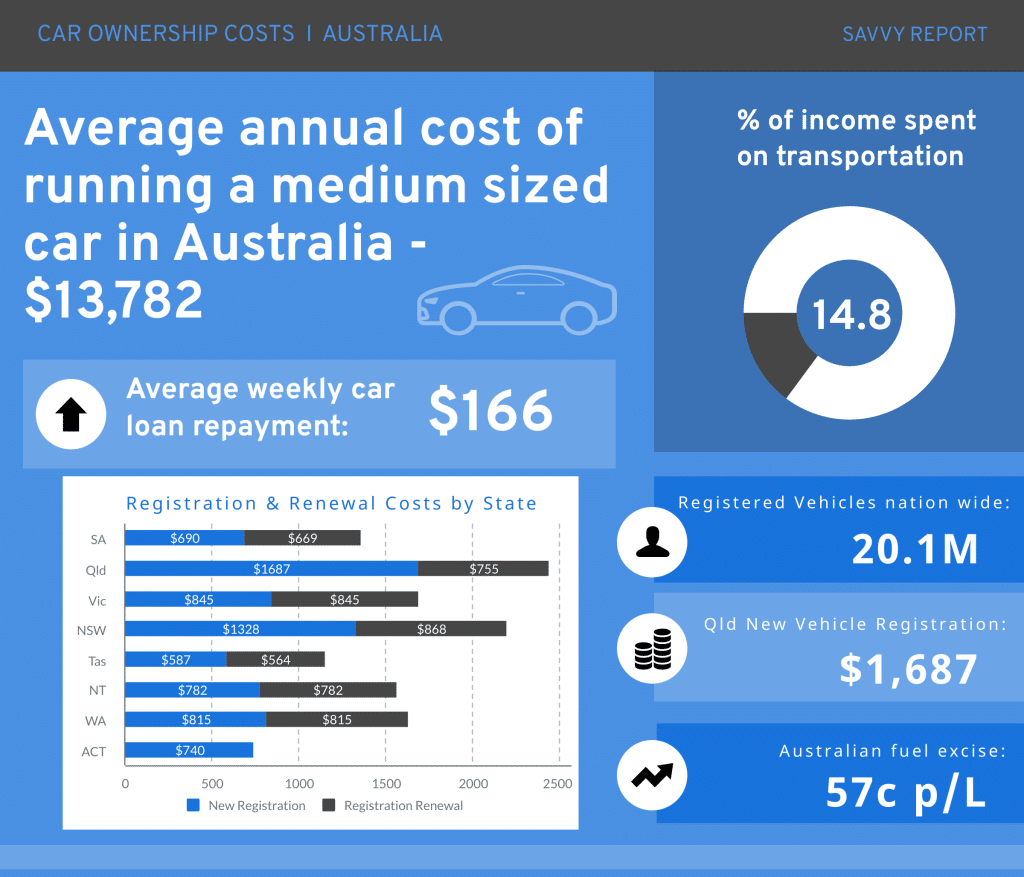

Australia is the great southern land – and to get anywhere, you’re going to need a car. In fact, there are 20.1 million registered vehicles on the road, according to the Australian Bureau of Statistics, suggesting a very large portion of adults of driving age are in fact car owners.

Though it’s undeniable that car ownership is not only convenient but the primary way to get around, Australians frequently complain that their cars are “cash sinks” – in terms of insurance, registration, repairs, maintenance, and the cost that only ever seems to go up: fuel.

Perceptions may not be reality, however. With that in mind, just how much does it cost to own a car in Australia?

Statistical overview

As mentioned, there are 20.1 million registered vehicles on the road. The average age of these cars are 10.6 years, an increase over 2020. 71.7% of all cars are petrol driven; followed by 26.4% using diesel, and 1.8% on “other,” presumably electric or hybrid vehicles.

An analysis of car ownership in 2016 by ID Community demographics showed that 51% of households in Australia had access to two or more motor vehicles.

Registration compared State by State

That dreaded week arrives for every driver – “rego” week. Where drivers part with a significant amount of cash just to keep their car (or cars plural) on the road. Every state is different, with some states deregulating the Compulsory Third Party insurance, such as New South Wales.

Depending on the state or territory, CTP is either an itemised inclusion in the total registration fee or paid separately. In NSW, for example, CTP or your “green slip” is separate. In Queensland, CTP is separate also, though will appear as an itemised inclusion on your registration quote. The ACT includes similar cover – the Motor Accident Injuries Insurance – in the registration fee. In Tasmania and the Northern Territory, SA and WA, CTP is included in the total, though some offer a choice of providers, while others do not.

Tasmania’s registration system is quite complicated – with the registration cost determined by the number of cylinders in the vehicle. Western Australia’s rego is determined by kerb mass, while NT’s rego fee will depend on the number of cylinders AND the size of the engine, measured in cubic centimetres.

In Victoria, registration fees differ depending on proximity to urban centres. Three classifications exist, which attract different fees: Metropolitan ($845.90), Outer metropolitan ($790.90) and Rural ($726). The stated reason for this difference is level of risk, ranging from high to low respectively.

In NSW, WA, and Tasmania, drivers have the option to choose their Compulsory Third Party insurance provider through the free market. This is commonly known as a “green slip.” In Victoria, CTP is regulated and administered through a government statutory body, the Transport Accident Commission. This doesn’t mean a car is “insured” against fire, theft, and damage to others or oneself – this is more akin to public liability insurance.

Compare this to the US states of Utah, New Jersey, Michigan, Idaho, and Colorado: where registration costs a goose egg: $0. The next best state? Arkansas, which costs just $8 per year.

Registration Costs by State

Source: Individual state motor vehicle registration bodies – rates calculated in December 2021 on a 2020, 4 cylinder petrol sedan, priced at $30,000 *CTP average of available quoted insurer prices.

Notes on this chart: All CTP greenslip premiums quoted by Allianz, which returned the highest price compared with all other insurers. Victoria registration rate dependent on area of registration: Metro (most expensive), outer Metro, or Rural (least expensive). All calculations are per annum.

Licence renewal fees

Licence renewal fees also vary from state to state – some states offer “good driver” renewals where the licence fee is waived in recognition of good behaviour (WA). It can also vary if the licence must be renewed at a Road Authority centre (for a new headshot) or online. In South Australia, the issue or renewal fee per year is $48. A one-year renewal in NSW for an unrestricted licence is $60, with discounts for the longer you renew your licence for. Heavy vehicle licences typically cost more – and seniors may need to submit eyesight or competency tests before they are approved for a licence (80 years and above.)

Ongoing costs of transport

According to the Australian Automobile Association, Australians spend a significant 14.8% of our income on transport costs as a national average – most of which is comprised of car loan repayments ($166.48), fuel ($78.04), and servicing/tyres ($30.13). This all rose sharply since Q4 2020, where total costs rose from $309.92 per week to $367.63 per week.

Sydneysiders pay $477.56 per week and 15.5% of their incomes; Melbourne $466.96 per week and 16.4% of their income.

As for a breakdown of private vehicle running cost by size of vehicle, see below:

Private vehicle average running costs

Source: RACQ

Australian fuel costs vs the rest of the world

Source: Energy.gov.au

This can’t all be blamed on fuel costs alone, though they are a major contributor to the overall cost of transport.

Australian Fuel costs vs the rest of the world

The average price per litre in Australia, if all taxes were excluded, would come to 87c – which means 56c is eaten up by excise and GST. In Japan, tax accounts for 84c in the price; Korea, $1.03. The lowest taxing country is the United States with only 19c going towards tax. It’s also worth noting most countries use RON 95 fuel in their vehicles, considered a “premium” product here. The average price of RON 95 in Australia is $1.59/L, with 57c going towards tax.

Insurance

Insurance in Australia is optional, but in most cases if your vehicle is under finance, may be a condition of loan approval. Comprehensive insurance covers vehicle theft, collisions, vandalism, hail or other weather damage, and accidents regardless of who is at fault. Many comprehensive policies also include roadside assistance, emergency accommodation, new-for-old replacement, and complimentary car hire. Of course, the more “extras” on offer, the more expensive the policy usually is.

You may also opt for cheaper alternatives – third party property damage insurance, which insures you against damage you may inflict on another vehicle – but if you or “acts of god” cause damage to your vehicle, you will have to pay for repairs out of pocket. The “middle” ground is third party fire and theft, which covers you if your vehicle is stolen or catches on fire (or explodes.)

The average insurance cost per household according to the AAA is $25.76 per week, with Melbourne shelling out the most at $34.62. This means the average annual premium (which is usually free from loading, or additional fees) is $1,340. That’s a $19 jump since Q2 2021.

Of course, if you do get into an accident and make a claim, you will have to pay an excess, which is between $600-$800 on average.

Of course, this can all vary according to age, sex, prior driving history, and licence status (i.e., if you are a provisional or probationary driver or not.)

Servicing and maintenance

Scheduled servicing and maintenance, according to the AAA takes up about 8.2% of yearly transport costs in Australia, averaged out to $1,567 per year – a $12 increase since Q2 2021. The most expensive place to get your car serviced is Canberra – setting you back an average of $2,083. It might almost be worth driving your ACT registered car to Adelaide to get it cheaper: where it costs almost half at $1,299 on average.

Toll Roads

Only three states operate toll roads: New South Wales, Queensland, and Victoria. As for how much these cost on average, Sydney was the most expensive at $88.24 a week, followed by Melbourne at $54.80 and Brisbane at $53.58 (all on average.)

Roadside assistance

Roadside assistance is often bundled as part of comprehensive car insurance – although we can pay for roadside assistance services after market. The national average price for roadside assistance was about $2.12 per week. This is also a type of “insurance” against flat tyres, battery issues, emergency fuel replenishment, and a lock-smithing service. This weekly fee is usually paid upfront on a yearly basis.

Car loan repayments

Loan repayments are hard to quantify as an average as every car purchase and car loan is different. AAA statistics say that that the average car loan repayment per year is $8,653 over all of Australia – the interesting statistic is that the difference between highest and lowest is only $118 – $8,721 in Perth and $8,603 in Darwin.

Savvy Managing Director Bill Tsouvalas says this hews closely with the average spend on cars, and where tastes are heading in terms of the marketplace.

“If we extrapolate these numbers to a standard five-year loan, this gives us $43,265. The average spend on a new car in Australia is about $40,729. We arrive at this figure because of the appetite for SUVs in Australia. In our last report, we found that for every standard car sold, four SUVs are driven off the lot. In 2020, almost half of new car sales were SUVs. SUVs are more expensive to buy and, in some cases, to run.”

Increasing prices due to inflation, COVID, supply chain issues

Ongoing issues with the COVID-19 pandemic such as industry shutdowns and the global semi-conductor shortage have led to an increase in prices – with used car prices soaring up 37% above the pre-pandemic high in February 2020.

The semi-conductor shortage has created a massive backlog for chips that not only affects automotive, but everything that uses electronics – games consoles, computer components, toys, household appliances, televisions, and almost anything you can plug in, rev up, or switch on.

Since many remain reluctant to take public transport amid ongoing COVID-19 infections, demand for new cars have also skyrocketed. This is despite shortages and wait times of nine months – or even more. According to the ABC, there’s been a 68% increase in new car sales since last year. However, a new report by the Federal Chamber of Automotive Industries shows that car sales in November 2021 dropped 15.3% over the previous year, as the supply shortage starts to bite into consumer sentiment.

That said, Australia is only 29,000 cars away from selling 1 million new vehicles throughout 2021 – with December’s peak period yet to come.

Saving on car costs

Tsouvalas says the only saving grace at the moment in terms of saving on car costs is at the back end – on car loans. “Car loan interest rates are at their lowest, possibly the lowest we’ll see in our lifetimes. If you are balking at the price of a new car, you also have to consider the amount of interest you’ll pay will be as low as you’ll get in most cases. Also remember newer cars may also be more fuel efficient, safer to drive, and may even attract lower interest rates due to high residual value. Make sure you weigh up the pros and cons – it could be a wise investment.”

ABS.gov.au - Motor Vehicle Census Australia

NSW.gov.au - Driver and Rider Licenses- fees

Vicroads.vic.gov.au - vehicle Registration Fees

Profile.id.com.au - Car Ownership

WorldPopulationReview.com - Car Registration Fees by State

RACQ.com.au - Owning and Maintaining a Car - Running Costs

AAMI.com.au - Does my Car Rego Include CTP Insurance?

RAC.com.au - How Much Does Car Rego Cost in WA?

Greenslips.nsw.gov.au - Price Check

Transport.wa.gov.au - License a Vehicle New to WA

https://www.transport.tas.gov.au/fees_forms/registration_fees

Transport.tas.gov.au - Registration Fees

Energy.gov.au - Australian Petroleum Statistics - 2021

ABC.net.au - COVID Drives up Demand for Cars, Leads to Long Waitlists, Soaring Prices