- The Savvy Promise

At Savvy, our mission is to empower you to make informed financial choices. While we maintain stringent editorial standards, this article may include mentions of products offered by our partners. Here’s how we generate income.

This guide provides general information and does not consider your individual needs, finances or objectives. We do not make any recommendation or suggestion about which product is best for you based on your specific situation and we do not compare all companies in the market, or all products offered by all companies. It’s always important to consider whether professional financial, legal or taxation advice is appropriate for you before choosing or purchasing a financial product.

The content on our website is produced by experts in the field of finance and reviewed as part of our editorial guidelines. We endeavour to keep all information across our site updated with accurate information.

Approval for a mobile phone plan is always subject to our lender’s terms, conditions and qualification criteria. Lenders will undertake a credit check in line with responsible lending obligations to help determine whether you’re in a position to take on the loan you’re applying for.

The interest rate, comparison rate, fees and monthly repayments will depend on factors specific to your profile, such as your financial situation, as well others, such as the loan’s size and your chosen repayment term. Costs such as broker fees, redraw fees or early repayment fees, and cost savings such as fee waivers, aren’t included in the comparison rate but may influence the cost of the loan. Different terms, fees or other loan amounts may result in a different comparison rate.

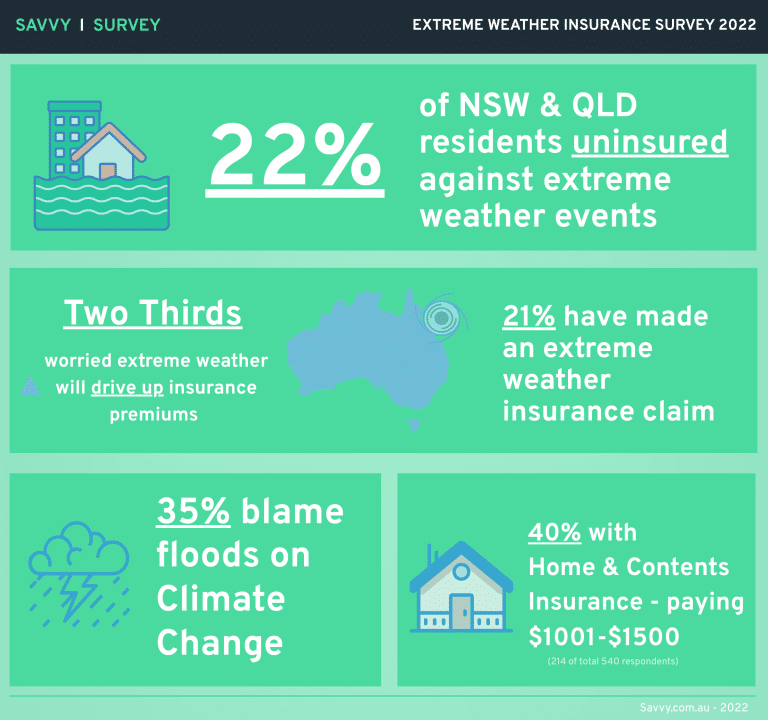

Savvy's 2022 representative survey of 1000 New South Wales & Queensland residents learns about insurance cover of everyday Australians, their experience with extreme weather, perception of risk and beliefs regarding the cause of recent extreme weather events.

- 21% of NSW and QLD residents have made extreme weather insurance claims

- Two thirds more worried than not extreme weather events will negatively impact insurance affordability

- 40% with home & contents insurance paying $1001-$1500

- 35% of residents blame climate change for ongoing weather disasters

A new 2022 survey of 1,000 New South Wales and Queensland residents has shown that approximately 22% are uninsured against extreme weather events such as flood, bushfire, or storms.

The survey, commissioned by Savvy, examined attitudes and insurance rates among 1000 NSW and Queensland residents, many of whom are currently facing significant flooding and property damage.

21.3% of respondents said that their homes had been affected by severe weather events to such an extent they had made an insurance claim. Of those that had made a claim, the largest proportion was for storm damage (124 respondents), followed by flooding (93 respondents).

Of the remaining 787 who hadn’t made an insurance claim, 177 stated flooding had affected their home since they had lived there, 150 had been affected by damaging winds, while 55 had been affected by bushfires.

When it came to insurance, 54% said that they had taken out Home & Contents insurance; 8% only for their homes, and 15.5% only for contents.

What do you believe is the cause of the recent extreme weather events on the East coast of Australia?

Has your home been affected by current floods, bush fires or extreme weather events to the extent you have needed to make an insurance claim?

Almost two thirds (61%) of respondents said that they fear these ongoing weather events will negatively impact home insurance affordability. 16.4% of respondents said their insurance premiums rose by up to 5%, with a further 16.4% reporting an increase of up to 10%. 32.2% of respondents said they have stuck by their insurer for more than five years.

Which of the following insurance products do you have for your home?

Perceptions of risk vs calculated risks

Discrepancies exist in the perceptions of risk between calculated risks by data collection and insurance firms.

Cyclone risk

22.7% of total respondents living in Queensland said they were of “No” or “Low” risk to exposure to Tropical Cyclones, while an Insurance Australia Group (IAG) report on natural perils said that Brisbane’s exposure was “High”, while that of regional QLD to cyclones was “Medium.”

Bushfire risk

22.2% of Brisbane and Sydney residents said they had “No” exposure to bushfires, while a further 23.4% agreed that their property had a “Low” bushfire risk. However, the IAG report shows a “Medium” risk for Sydney and a “Medium” risk for Brisbane, suggesting that residents in these capital cities significantly underestimate their exposure to bushfires.

Flood risk

In terms of flood, 44.1% reported a “Low” risk, while the IAG report showed a “High” to “Medium” risk for NSW (metro and regional) and a similar risk for Brisbane and regional Queensland.

What is your current annual Home Insurance Premium?

What is your current annual Contents Insurance Premium?

Bill Tsouvalas, Managing Director of Savvy;

“There is a definite gap between what’s been recorded by experts and captured by real world data relative to the perceptions of those risks among the general population,” says Savvy CEO Bill Tsouvalas. “The gap between reality and perception may mean people will underinsure rather than seek out adequate coverage, which could devastate families caught in extreme weather events who lose everything.”

What is your current annual Home & Contents Insurance Premium?

Blaming it on the weather?

As for what is driving these extreme weather events, 35.1% said the recent floods and storms are a result of human-caused climate change; 27.3% said it’s a result of being in the La Niña “cool” phase of the El Nino-Southern Oscillation variation. 22.8% reported that the extreme weather was simply “unpredictable.”

Younger people were much more likely to cite climate change as the reason, while older people pinned the events on La Niña or simply “unpredictable extreme weather.”

a) For what reasons have you made a home insurance claim in the past five years relating to natural disasters?

b) If no claim was made – Which of the following extreme weather events have affected your current residence since you’ve lived there?

For more information, contact Adrian Edlington – [email protected]

Savvy's Extreme Weather & Insurance survey (n=1000), March 2022.

Sources:

IAG Report - Table 3, Regional GDP, Population, 2014-15 and Natural Perils Risks, pg. 5.