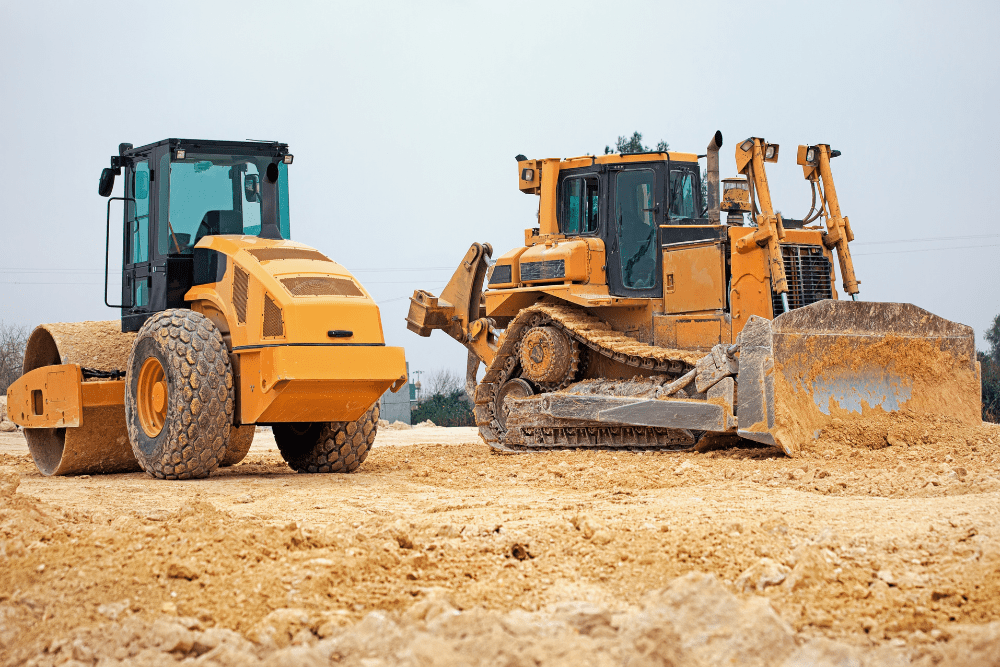

A finance lease is a type of leasing arrangement between a business and a leasing company that effectively allows you to rent an asset for a set period. Whether you need a car for your small business or heavy-duty machinery for your earthmoving company, you can get the ball rolling with Savvy today!

Why apply for a business loan with Savvy?

Expert brokers

You can speak with one of our specialist commercial brokers who can walk you through a range of loans to best suit your company's needs.

Over 40 lending partners

You can compare business loan offers, through a range of trusted lenders, maximising your chances of a great rate.

Fast online process

You can fill out our simple online form to generate a free business finance quote within minutes. You can also come back to it at any time.

How do finance leases work?

Here's a quick rundown of how finance leases work, from application to the conclusion of the term:

- Select the vehicle or asset you want to lease

- Decide on the lease term you want (between one and five years)

- Determine whether you want to include your car’s on-road costs in the payments (fully-maintained) or leave them out (non-maintained, which is the more common option for these leases)

- Agree a residual value with your leasing company

- Receive your vehicle or asset and start making your lease payments on a weekly, fortnightly or monthly basis

- Pay the residual to conclude your lease agreement

What happens at the end of my finance lease?

As mentioned above, finance leases come with a residual payment at the end of the term. You’re required to cover the cost of this residual as part of the agreement, which you can do in several different ways:

- Pay the residual out of pocket and take full ownership of the asset

- Sell or trade in the asset to cover the residual and end the lease

- Sell or trade in the asset to cover the residual and start a new lease with a different asset

- Refinance the residual and continue leasing the same asset with an extended term

Under a finance lease, the risk of obsolescence falls to the lessee, being your business. This means it’s your responsibility to look after the car, as you’ll have to buy or sell it at the end of the agreement.

What can I use a finance lease for?

There’s a wide range of assets, namely vehicles and equipment, that you can lease with one of these deals. Here’s a selection of what you may be able to lease:

- Cars

- Trucks

- Vans

- Utes

- Motorcycles

- Buses

- Forklifts

- Cranes

- Diggers

- Tractors

- Heavy machinery

- IT equipment

- Medical equipment

- Factory assets

How are finance leases different from operating and novated leases?

Finance leases aren’t the only option you’ll come across in your travels. There are two others that are important to consider, which are operating and novated leases. We’ve broken down how each option works here in this table:

| Operating lease | Finance lease | Novated lease | |

|---|---|---|---|

| Suitable for? | Businesses and business owners | Businesses and business owners | Employees or business owners paying themselves a salary |

| Usage? | At least 51% commercial | At least 51% commercial | No usage restrictions |

| Assets available? | Cars and certain road vehicles | Commercial and non-commercial vehicles and equipment | Cars with payloads under 1,000kg that seat nine or fewer |

| Payments made by? | The business | The business | The employer, through pre-tax deductions from the employee’s salary |

| Ownership? | Rests with the lessor at all times | Rests with the lessor until residual is paid, after which it’s transferred to the lessee | Rests with the lessor until residual is paid, after which it’s transferred to the lessee |

| Term length? | One to five years | One to five years | One to five years |

| Options at the end of the lease? | Return the vehicle to the lessor | Pay the residual and buy the car Sell or trade in the car to cover the residual Refinance the residual and extend the lease |

Pay the residual and buy the car Sell or trade in the car to cover the residual Refinance the residual and extend the lease |

| On-road costs included? | Optional | Optional | Optional |

| Tax benefits? | Up to 100% of lease payment claimable (subject to asset usage) GST claimable on asset purchase and all included expenses |

Up to 100% of lease payment claimable (subject to asset usage) GST claimable on asset purchase and all included expenses |

Reduction of income tax through salary sacrificing GST claimable on car purchase by lessor |

Note: tax benefits may differ between businesses, so it's important to speak with a professional if you're unsure about what you can and can't claim.

Are my lease payments tax-deductible?

As mentioned above, you may be able to claim up to 100% of your finance lease payments as a tax deduction. However, the amount you’re able to claim will ultimately come down to how much you use your asset for commercial purposes.

For example, if you’ve decided to lease a sedan for your small business that you can also use to ferry the kids to and from school, that may only end up at a commercial usage of 65%. In this case, you’d only be able to claim up to 65% of your payment and any other claimable expenses, such as GST.

If you aren’t 100% sure about what you can and can’t claim as part of your lease agreement, you should speak with your accountant or a tax professional.

The benefits of finance leases

-

Keep more funds free upfront

Leasing your assets instead of buying them frees up your cashflow, giving you more choice of how to spend your business’ cash than if you took one big hit on a purchase.

-

Flexible options for dealing with your residual

Although you’re required to pay off the residual at the end of your lease, you’ll have several options to choose from, allowing you to select the best one for your situation.

-

Choose whether to include on-road costs in your payments

You’ll also have the flexibility to decide whether to incorporate your on-road costs into your lease payments and save on admin or manage them yourself, which could potentially save you money.

-

Enjoy tax benefits

Of course, as a business expense, you’ll be able to claim up to 100% of the cost of your lease as a tax deduction.

WHAT OUR CUSTOMERS SAY ABOUT THEIR FINANCE EXPERIENCE

Savvy is rated 4.9 for customer satisfaction by 6323 customers.

Applying for a lease with Savvy

-

Tell us about yourself and what you want to lease

First of all, fill out our simple online application form. This will tell us details like what you want to buy, how much you need and your business’ structure, revenue and trading time.

-

Send through any required documentation

We may require further information in some cases to verify parts of your application. If this is the case, we’ll ask you to submit additional documents via our online portal.

-

Discuss your next steps with a Savvy consultant

Once we get all the info we need, we’ll get to work comparing options from our lender panel. A member of our consultant team will give you a call to talk about your options.

-

Have your application submitted for formal approval

After you give us the all-clear, we’ll get to work preparing your application to submit to your lender. This can be formally approved as soon as within 24 hours.

-

Sign your contract and settle the deal

Once you receive approval, you’ll be sent all the required contracts and forms you’ll need to sign, which can be done electronically. We’ll handle settlement and the asset can be yours before you know it!