Buying equipment for your business is a big investment. At Savvy, we offer a range of flexible and tailored commercial finance options to help you get the equipment you need, when you need it. We work with some of Australia’s top lenders to secure competitive finance deals that work for you. Get started with us today with a free, no-obligation quote!

Why apply for a business loan with Savvy?

Expert brokers

You can speak with one of our specialist commercial brokers who can walk you through a range of loans to best suit your company's needs.

Over 40 lending partners

You can compare business loan offers, through a range of trusted lenders, maximising your chances of a great rate.

Fast online process

You can fill out our simple online form to generate a free business finance quote within minutes. You can also come back to it at any time.

Business lenders you can compare

What are my finance options when buying equipment for my business?

When financing equipment for your business through Savvy, you typically have two main options:

- Chattel mortgage: with a chattel mortgage, a lender provides the funds to purchase your equipment, with the asset used as collateral for the loan. You have immediate ownership and access to the equipment and you repay the loan over a set period, usually from one to seven years. Since the asset secures the loan, it may be repossessed by the lender if your business cannot meet its repayment obligations.

- Finance lease: under a finance lease, the lender retains legal ownership of the equipment throughout the lease term – usually from one to five years – while your business leases it for a fixed period at a fixed monthly cost. You’re responsible for all maintenance and operating costs. At the end of the term, you may have the option to purchase the asset for an additional amount, or you can return it.

If you are simply looking for finance for road vehicles like trucks, vans or cars, you may also be able to take out an operating lease through Savvy. Under this arrangement, you do not own the vehicle but essentially rent it for a set period. The lessor typically covers maintenance and operational costs during the term, and at the end of the lease, you return the vehicle.

What kind of equipment can I finance?

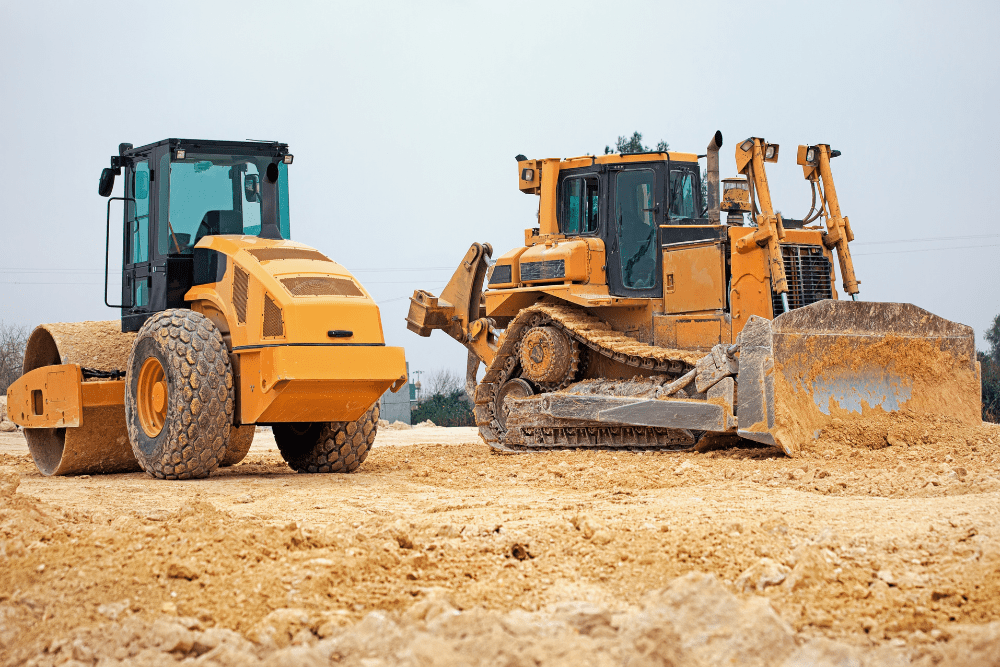

You can finance a broad range of equipment to support and perform business operations. This includes plant – larger, fixed machinery and equipment commonly used in industrial or trade settings – smaller equipment and business vehicles, including:

- Heavy machinery: industrial machines, heavy plant equipment, forklifts, prime movers

- Smaller equipment: portable power tools, hand tools

- Vehicles: cars, vans, utes, trucks, trailers, buses

- Construction equipment: bulldozers, cranes, frannas, excavators

- Agricultural equipment: tractors, harvesters, planters

- Restaurant equipment: furniture, ovens, fridges, freezers, dishwashers.

- Retail equipment: shop fitout, IT, POS systems

What influences the cost of equipment finance?

-

Asset

The equipment type, value and age all play a role in your finance deal. Newer equipment often attracts lower rates, as it depreciates more slowly and has a higher resale value, which reduces the lender’s risk. Furthermore, some items will depreciate a lot faster than others – for example, computer equipment generally needs replacing every few years while some heavy-duty manufacturing and construction equipment can last for decades.

-

Finances

Your business financials and even your personal borrowing profile can affect the rate and terms of your equipment finance. Stronger financials may open up lower rates or more favourable terms, while less-established businesses might face higher costs.

-

Interest rates

Interest rates on equipment finance are typically lower than unsecured loans, as the asset secures the financing. Rates can be either fixed, providing stable payments, or variable, which may fluctuate. The interest rate type can influence how much you pay over time.

-

Balloon payment

With both finance leases and chattel mortgages, you may be able to choose a balloon or residual payment at the end of the term. These payments reduce your monthly costs but leave a final, larger amount to settle. This structure helps make repayments more manageable but requires planning for the final lump sum.

-

Fees

As with other types of finance, equipment finance typically comes with additional fees, such as establishment fees when setting up the loan, which cover administrative costs, early termination fees if you end the lease or loan early and valuation fees if the asset needs to be valued. However, the fees that apply vary depending on the terms and lender policies.

Types of business finance

WHAT OUR CUSTOMERS SAY ABOUT THEIR FINANCE EXPERIENCE

Savvy is rated 4.9 for customer satisfaction by 6324 customers.

How to apply for equipment finance

-

Tell us about yourself and what you want to buy

First of all, fill out our simple online application form. This will tell us details like what you want to buy, how much you need and your business’ structure, revenue and trading time.

-

Send through any required documentation

We may require further information in some cases to verify parts of your application. If this is the case, we’ll ask you to submit additional documents via our online portal.

-

Discuss your next steps with a Savvy consultant

Once we get all the info we need, we’ll get to work comparing options from our lender panel. A member of our consultant team will give you a call to talk about your options.

-

Have your application submitted for formal approval

After you give us the all-clear, we’ll get to work preparing your application to submit to your lender. This can be formally approved as soon as within 24 hours.

-

Sign your contract and settle the deal

Once you receive approval, you’ll be sent all the required contracts and forms you’ll need to sign, which can be done electronically. We’ll handle settlement and the asset can be yours before you know it!

Commercial loan eligibility and documentation

Eligibility

-

Age

You must be at least 18 years of age

-

Residency

You must be an Australian citizen or permanent resident (or, in some cases, an eligible visa holder)

-

ABN registration

Have an ABN registered in your name (available from as soon as one day after registration)

-

Usage

Meet commercial asset usage requirements (at least 51% of total usage)

-

Credit score

You must meet your lender’s minimum personal and business credit score requirements

-

Commercial asset

The asset you choose to buy must meet your lender’s requirements in relation to its type, age and condition

Documents

-

Personal information

Such as your full name, date of birth, address and contact details

-

Driver's licence

Front and back (or another form of government-issued ID)

-

Assets and liabilities

Information about your business’ assets and liabilities, as well as those in your name

-

Asset details

Information about your asset, including its model and age, is worthwhile having on hand

-

Business statements

Business Activity Statements (BAS) and business bank statements may be requested, but not always