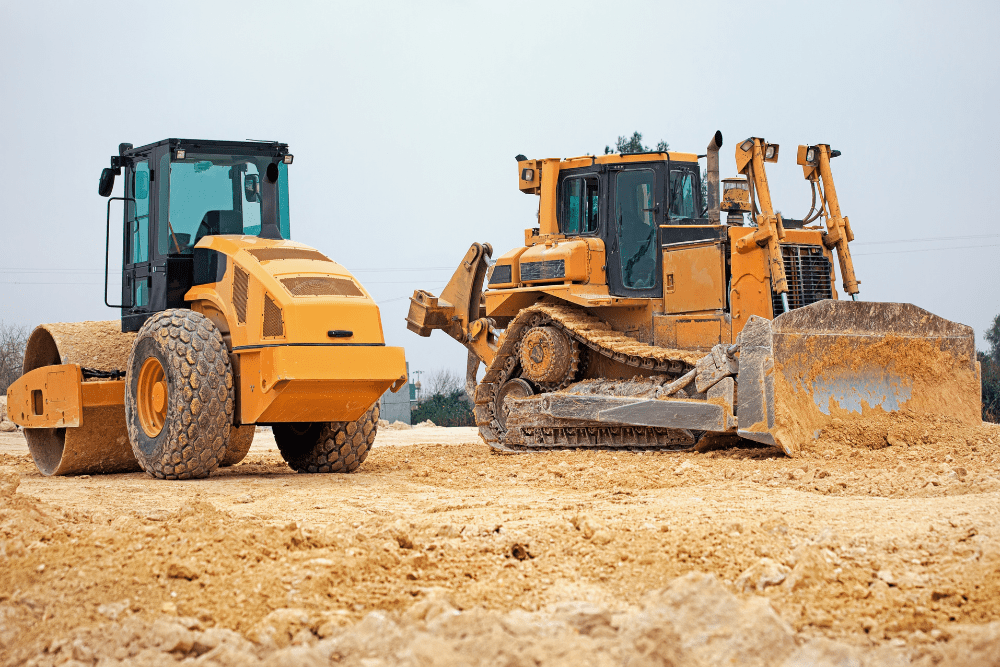

Lock in a competitive finance deal for your tractor

Finding a financial product that fits your needs should not feel like looking for a needle in a hay stack. At Savvy, we understand the need to find affordable agricultural equipment at an affordable price. Our experience in financing for tractors of all kinds will ensure that you get a personalised solution to make owning and operating a tractor easy and affordable.

Whether you're financing a utility tractor, specialty tractor, row crop tractors, or a 4WD track tractors, we're here to help. Get a free, no-obligation quote today!

Why apply for a business loan with Savvy?

Expert brokers

You can speak with one of our specialist commercial brokers who can walk you through a range of loans to best suit your company's needs.

Over 40 lending partners

You can compare business loan offers, through a range of trusted lenders, maximising your chances of a great rate.

Fast online process

You can fill out our simple online form to generate a free business finance quote within minutes. You can also come back to it at any time.

Business lenders you can compare

Types of business finance

WHAT OUR CUSTOMERS SAY ABOUT THEIR FINANCE EXPERIENCE

Savvy is rated 4.9 for customer satisfaction by 6324 customers.

How to apply for a commercial loan with Savvy

-

Tell us about yourself and what you want to buy

First of all, fill out our simple online application form. This will tell us details like what you want to buy, how much you need and your business’ structure, revenue and trading time.

-

Send through any required documentation

We may require further information in some cases to verify parts of your application. If this is the case, we’ll ask you to submit additional documents via our online portal.

-

Discuss your next steps with a Savvy consultant

Once we get all the info we need, we’ll get to work comparing options from our lender panel. A member of our consultant team will give you a call to talk about your options.

-

Have your application submitted for formal approval

After you give us the all-clear, we’ll get to work preparing your application to submit to your lender. This can be formally approved as soon as within 24 hours.

-

Sign your contract and settle the deal

Once you receive approval, you’ll be sent all the required contracts and forms you’ll need to sign, which can be done electronically. We’ll handle settlement and the asset can be yours before you know it!

Commercial loan eligibility and documentation

Eligibility

-

Age

You must be at least 18 years of age

-

Residency

You must be an Australian citizen or permanent resident (or, in some cases, an eligible visa holder)

-

ABN registration

Have an ABN registered in your name (available from as soon as one day after registration)

-

Usage

Meet commercial asset usage requirements (at least 51% of total usage)

-

Credit score

You must meet your lender’s minimum personal and business credit score requirements

-

Commercial asset

The asset you choose to buy must meet your lender’s requirements in relation to its type, age and condition

Documents

-

Personal information

Such as your full name, date of birth, address and contact details

-

Driver's licence

Front and back (or another form of government-issued ID)

-

Assets and liabilities

Information about your business’ assets and liabilities, as well as those in your name

-

Asset details

Information about your asset, including its model and age, is worthwhile having on hand

-

Business statements

Business Activity Statements (BAS) and business bank statements may be requested, but not always