Outstanding tax debts owed to the Australian Taxation Office (ATO) are among the most common debts carried by small businesses in Australia. Indeed, small businesses accounted for over 65% of the $55.9 billion in total debt owed to the ATO as of August 2025.

With these debts growing, and against the backdrop of recent changes to the deductibility of their interest, SMEs and larger businesses are increasingly turning to tax debt loans to help them clear their ATO balances. These loans allow owners to space out the payment of the debt over a more manageable period, but they may not be available to all businesses.

What are business tax debt loans?

Tax debt loans are often short-term business loans taken out to cover the balance of any outstanding or overdue debts to the ATO. They’re flexible to the needs of small and medium businesses, with a wide borrowing range (depending on your business’ turnover) and varied term lengths. However, these will also vary based on the type of tax debt loan you take out.

It’s important to understand that most lenders don’t offer a single “tax debt loan” product for businesses. Several different types of loan and finance products can help you cover your tax debts, so the one you choose will depend on what’s available to your business or is best suited to your needs.

What tax debt loan options are available to my business?

Unsecured business loans

These are the most common for SMEs. Unsecured business loans don’t require any collateral, with lenders basing their approval on the strength of your business. These can start from as little as $5,000 and can reach up to $250,000 to $300,000 at the higher end, with terms tending to max out at three to five years. Unsecured loans are often quicker to approve than secured loans, sometimes within a matter of hours of applying.

However, if your business hasn’t been running for a long time or doesn’t have a borrowing history to fall back on, lenders may only be willing to lend a small amount over a very short term, such as one to three months. You may be required to provide a personal guarantee in such situations. These loans also come with higher interest rates and fees than secured loans.

Secured business loans

With a secured business loan, you can make use of a business asset like equipment or property as collateral. This can potentially expand your borrowing power into the millions of dollars (as long as your business can afford it) and loan terms of up to 30 years in some cases.

If you’re the owner of a smaller business with a tax debt, putting up an asset as loan security can boost your chances of approval for the loan you want significantly. You’ll have to weigh up the risk of losing your asset should you become unable to repay your loan debt, though. It’s also worth noting that these may take longer to process, especially for larger sums.

Business line of credit/overdraft

Lines of credit and business overdrafts aren’t as common when it comes to dealing with tax debts. If the debt is only relatively small and you already have one of these open, it may be a convenient way to clear it.

However, because interest rates and fees charged on these products are generally much higher compared to standard business loans, you should only use one if you’re confident that you’ll be paying off within a short period. Additionally, some lines of credit and overdrafts come with lower caps of $50,000 to $100,000, making them unsuitable for larger tax debts.

Invoice finance

If you’re a business that deals in invoicing clients and the amount you’re owed exceeds your tax debt, this could also be an option. Invoice financing, unlike the other options here, doesn’t require any money to be borrowed. Instead, you can be paid up to 85% and 95% of your outstanding invoices’ value, with the remainder to come once the invoices are paid (minus fees from your financier).

The amount you’ll receive will depend on the type of invoice finance you choose, with invoice factoring and invoice discounting both available.

What tax debts can I cover with a business loan?

Lenders will still consider the nature of your debt to the ATO when assessing your business loan application. Here are some different situations and their likelihood of approval for a tax debt loan:

- Error in calculating taxes: if your accountants have made a one-time error when preparing your BAS or tax return, lenders will generally be more lenient. They should see that this isn’t an error made by you.

- Capital Gains Tax (CGT) debt: if you’ve incurred a tax debt due to profit made from the sale of property, lenders may be more likely to approve your tax debt loan. Property sales are very infrequent for most businesses, so they’ll usually be seen as a once-off.

- Rapid business growth: if your business experiences unexpectedly rapid growth and is forced to exhaust cash flow reserves to keep up, you may find it tricky to pay your tax debt. As long as you can show that you’re equipped to adjust to this growth, though, lenders can approve your application.

- Tax return not submitted: if the reason you have a tax debt is that your return wasn’t lodged, this may be more of an issue for lenders. Failure to complete this step could indicate to your lender that you aren’t dependable enough.

Business tax debts: 2025

The big change coming to businesses with tax debts in 2025 is that the Australian Government has removed the ability to deduct income tax interest on ATO debts, which came into effect on 1 July 2025. Any general interest charge (GIC) or shortfall interest charge (SIC) incurred after this date is not tax-deductible. However, interest incurred up to 30 June is still claimable.

What this means for businesses is that the longer their tax debt remains outstanding, the more expensive it’ll become. There are now greater time and financial pressures on SMEs to clear their tax debts before the GIC or SIC on those debts becomes too much to handle.

We’ve already begun to see the impact of this change, with broking aggregator LMG reporting a significant 486% spike in business finance enquiries in the first half of 2025 compared to the same period last year.

Is business loan interest tax-deductible?

Yes – you can claim the portion of your business loan’s interest equal to the commercial usage of your funds. This means that you may be able to claim up to 100% deduction on your loan’s interest if you exclusively use the funds towards business expenses. However, it’s crucial to understand that each business is different, so you should check with your accountant or a tax professional to confirm what you can and can’t claim.

Business tax debt defaults: 2025

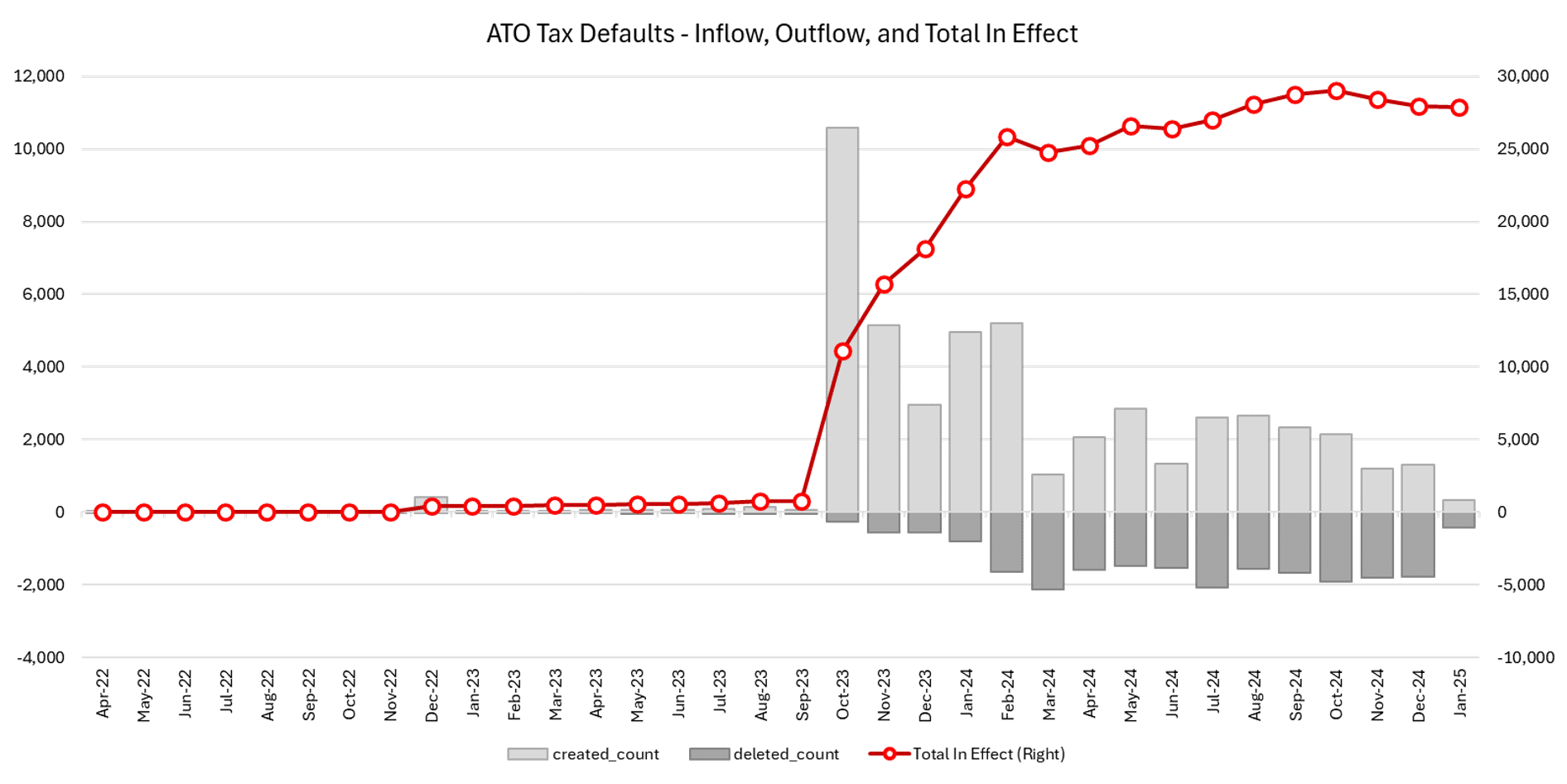

As mentioned, small to medium business tax debt is reaching new heights, which comes off the back of more lenient debt collection during the pandemic. We’ve seen it balloon to approximately $36.6 billion in 2025, with those on the higher end of the debt default scale at greatest risk of collapse.

According to CreditorWatch, the 12 months to the end of January 2025 saw 31% of private businesses with ATO debt defaults either voluntarily or involuntarily close their doors. These debts are defined as exceeding $100,000 and being 90 or more days past due.

Over half (52.0%) of all electricity, gas, water and waste services with such ATO debts failed, ahead of information, media and telecommunications (47.8%), mining (42.9%) and food and beverage services (41.0%). You can see the breakdown of the ten businesses with the highest rates of failure with ATO defaults reaching or exceeding that mark in the 12 months up to January 2025 in the following graph:

You can also see how the number of defaults (27,867 as of 31 January 2025) and business closures have gone up since April 2022 here:

Source: A third of private businesses with ATO debt defaults of $100k or more have closed in past year, CreditorWatch

How to apply for a tax debt loan through Savvy

-

Complete our online form

Start by sharing some information about your business and the type of finance you’re after.

-

Submit any further documents we need

Send additional documents to verify your identity and your business’ turnover (as well as evidence of your tax debt).

-

Discuss your finance options

Your broker will give you a call and talk through your business’ finance options.

-

Have your application prepared

We’ll put together your formal application and submit it to your lender for assessment.

-

Get approval and sign off

Once you’re approved, sign the documents and have the funds transferred to your business’ account.

Why apply for a business loan with Savvy?

Expert brokers

You can speak with one of our specialist commercial brokers who can walk you through a range of loans to best suit your company's needs.

Over 40 lending partners

You can compare business loan offers, through a range of trusted lenders, maximising your chances of a great rate.

Fast online process

You can fill out our simple online form to generate a free business finance quote within minutes. You can also come back to it at any time.

Is my business eligible for a tax debt loan?

Each lender has its own eligibility requirements, as does each business finance product. However, the general eligibility criteria you’ll need to satisfy are as follows:

- You must be at least 18 years of age

- You must be an Australian citizen, permanent resident or eligible visa holder

- You must have an ABN registered in your name

- Your business loan funds must be used at least 51% for commercial purposes

- You must meet your lender’s minimum personal and business credit score requirements

- The reason for your business’ tax debt must be acceptable

You’ll also have to provide all the documents your lender needs to assess your application. While these also vary depending on who you apply with, you’ll need the following as a minimum:

- Personal information, such as your full name, date of birth, address and contact details

- ID (such as your driver’s licence)

- Information on your personal and business assets and liabilities

- Evidence of your tax debt, such as through statements from the ATO

- Business Activity Statements (BAS) and business bank statements may be requested, but not always

Business tax debt loan alternatives

An alternative to taking out a loan is agreeing a payment plan with the ATO. This plan will be set out to help you clear your debt in the shortest possible time and doesn’t involve borrowing any money. For tax debts of $200,000 or less, you may have the option to set up your payment plan online or the ATO’s self-help phone line. However, for debts over $200,000, you’ll need to contact the ATO directly.

Interest will still apply to your debt. As of Q3 2025 (July to September), the annual GIC rate is 10.78% p.a., which will drop further to 10.61% in Q4. However, some businesses may qualify for a 12-month interest-free arrangement. You’ll have to meet the following criteria to be eligible:

- Your business’ annual turnover is under $2 million.

- Your business has a good history of paying debts and lodging returns and statements, which means one or no payment plan defaults within the last 12 months and no outstanding activity statement lodgements.

- Your business owes up to $50,000 from an overdue activity statement for up to 12 months.

- Your business isn’t able to get a loan elsewhere.

- You can show that your business will remain viable into the future.

When you have a tax debt that you might have an issue paying off, it’s often the best first step to let the ATO know as soon as possible. This is especially the case if your business qualifies for an interest-free plan.

- Tax debts drive record level of calls to financial helplines, as ATO denies 'heavy-handed' methods - ABC News

- Denying deductions for ATO interest charges - Australian Taxation Office

- General interest charge (GIC) rates - Australian Taxation Office

- Business lending enquiries climb amid ATO debt rule changes - Mortgage Professional Australia

- A third of private businesses with ATO debt defaults of $100k or more have closed in past year - Australian Institute of Credit Management

- Payment plans - Australian Taxation Office

- Contact us - Australian Taxation Office

- If you don’t pay - Australian Taxation Office