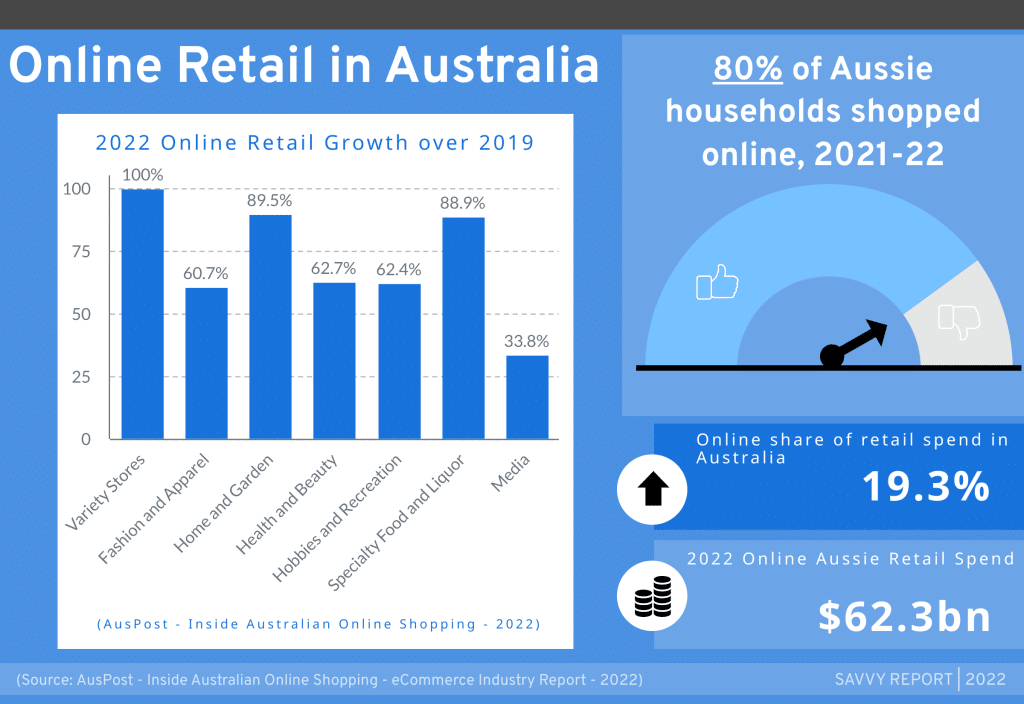

Over 2021-2022, over 80% of Australian households bought something online – spending $62.3 billion with a growth factor of 12.3%. Savvy investigates the latest AusPost data to learn who is buying, what’s popular, what consumers care about, and where online retail is headed into the future.

- Most active online shoppers comprise 15.3% of all shoppers, but account for 49% of the volume

- 3 in 4 Australian households concerned about sustainability in their online shopping

Online shares 19.3% of retail spend in Australia - 5.4 million Australian households bought at least something online monthly during

- 93% of respondents say they’ll maintain or increase online shopping activity in 2022

If we hadn’t done ourselves, we’ve known someone who bought something online during the COVID-19 pandemic. According to a study by Australia Post, 9.2 million Australian homes bought something online during 2021 – an increase of 39% over 2019.

Australians spent a mammoth $62.3 billion on physical goods bought online. This represents a 19.3% share of all retail sales in Australia which was an increase of 23.4% year on year. These figures reflect a similar sentiment to the findings of our earlier May online shopping report, which identified sales to date at $62 billion.

Compare this to the broader retail sector which racked up $323.7 billion with a 4.3% year on year increase.

Online shopping is booming in Australia – and will continue for the foreseeable future. In this report, we’ll analyse where online sales are in Australia, growth by category, what impact active and casual shoppers have on the industries, and which categories are most popular.

An overview of online sales in Australia

In many ways, the COVID-19 pandemic, especially in frequently locked down cities such as Melbourne, precipitated the rise of online retail as traditional retail was limited or closed completely.

An astounding 73.1% more purchases were made online in 2021 compared to 2019 – a stark change in behaviour largely driven by the pandemic.

Metropolitan year on year growth for online retail was 12.9% – a 77% growth compared to 2019. The regions also shot up, with a 10.6% year on year growth, or 64% growth in 2019. The ACT and NSW recorded above average growth compared to 2020 and 2019.

Growth by category

The top three categories in 2021 were variety, fashion & apparel, and home & garden sales. The product categories with above average growth compared to 2020 and 2019 were athleisure (activewear/casual wear), baby products, footwear, major & discount stores, online marketplaces (eBay, Gumtree etc.), pet products, and tools & garden.

Frequency of online shopping

5.4 million households purchased something online monthly in 2021, representing a 7.3% year-on-year increase. 9.2 million households purchased something online at least once in 2021 – representing 81% of all Australian households.

Australia is slightly above the global average when it comes to online shopping at least once a week (25% vs 24%) but lags behind other advanced economies such as South Korea (53%), the United States (38%) and the United Kingdom (34%.) Even outside the G7, China (50%), India (46%) and Indonesia (46%) are online shopping more often than not.

That said, 84% of all Australians shop online at least once a month, 4% more than the rest of the world.

Households are also buying more often, with 15.9% of households buying online more than 52 times per year – a huge increase over 5.8% in 2019. In 2021, more households made online purchases at least once per fortnight – an increase of 112% from 2019, or 1.6 million to 3.4 million households.

The frenzied vs the casuals – active vs occasional shoppers

According to AusPost, there are four categories of online shoppers in Australia: the occasional shoppers, active shoppers, very active shoppers, and Super Shoppers.

The occasional shoppers comprise 30.5% of online shoppers and 4.2% of the total online shopping volume. These 2.8 million Australian households have about one to four active months of online shopping and shop from an average of about three retailers per year. Occasional shoppers may have bought more during lockdowns, but are perfectly happy to go in-store now the option is available to them.

Active Shoppers comprise 2.5 million Australian households, or 26.7% of online shoppers. They contribute 15% of the total shopping volume online. They purchase from a greater variety of retailers, up to ten per year. These shoppers are active five to eight months of the year and favour marketplaces, so they can make comparisons and, hopefully, savings.

A further 2.5 million Australian households are considered Very Active Shoppers, active most of the year and averaging 19 retailers per year. They comprise 27.5% of all online shoppers and 31.8% of the volume. These shoppers are veteran online shoppers, trusting online retailers and knowing where the best bargains are. They may be participants of online loyalty programs, spurring on further online retail spending.

The Super Shoppers account for almost half (49%) of the total volume yet comprise 1.4 million or 15.3% of online shoppers. They purchase at least once per week and frequent a whopping 41 different online retailers. Super Shoppers are online bargain hunters and purchase more often from retailers who offer larger product lines and incentive programs. Their online purchase habits also span most of the online shopping categories.

Sustainability

Three in four Australian households consider sustainability important when they shop online. Businesses are responding to these concerns, with 88% saying they are employing some type of sustainable practice or products. 34% of these businesses have experienced upticks in customer retention and company culture.

People are most likely to purchase sustainable groceries, fashion, and beauty products from online retailers.

Sentiments in online shopping: poised for growth?

The vast majority 93% – of respondents in a recent survey said they’ll maintain or increase their online shopping in 2022. This is despite a flattening in the overall trend of online shopping.

Shoppers also intend to buy more local products online. 31% of Australian shoppers plan to buy more local products, which could signal more opportunity for local retailers.

Click and collect, where a customer picks up an item from a retail store or distribution point rather than having it shipped directly to their door, is also becoming more common, growing to a 13.6% share of shipping method. Most respondents who choose to click and collect have done so due to its immediacy and usually being cheaper than shipping (e.g., some retailers offer click and collect for free.)

Lockdowns accelerated the switch to online shopping, but the trend is slowing down. In New South Wales the average online purchase volume during lockdown was 1.7x the volume in non-lockdown months. In 2020, growth over two years was 83%, almost double that of 2019. This slowed to 73% in 2021. This is still a remarkable growth number for any industry, however.

Also, shoppers are more active online during the day than night, with an 11% drop in mid-evening purchases and a corresponding rise in afternoon (2pm to 5pm) purchases.

Bill Tsouvalas, Savvy Managing Director & personal finance expert;

“Maintaining a great customer experience, offering incentives, maintaining sustainability, and providing as much detail about goods and services online are the ingredients to success for online retailers. It only stands to reason that the migration to online shopping will continue due to convenience and the prevalence of online payment methods, such as PayPal and credit cards. Bricks and mortar retailers that resist the transition will do so at their peril.”

- Ecommerce Industry Report 2022 - Auspost.com.au