How do business loans work?

Business loans are designed to help business owners cover a wide range of expenses. There are several types of business finance, with each option working slightly differently. However, they can either be unsecured (no asset collateral) or secured (asset collateral attached). This collateral can be commercial property, assets or your home.

The nature of the loan and the application process differ depending on the size of your business. For example, small businesses will typically have their borrowing power capped at a lower range to match their earning potential and may require low doc finance if they aren’t yet established. However, large GST-registered corporations will often be able to borrow huge full doc loan sums far beyond their lender’s advertised maximum.

Business loan interest rates

Interest rates available through Savvy lending partners correct as of 16 Februsry 2026. Rate calculations based on a $50,000, five-year secured loan for the purchase of a business asset for a business with an ABN of eight years or older and GST registration of four years or older. These are the minimum rates available for the selected profile through each lender. The rate you receive when you apply through Savvy may be different to the rates listed above.

The interest rate on your business loan will depend on a wide range of factors. These include:

- Secured or unsecured: as mentioned, you’ll receive lower rates for secured loans than unsecured.

- The size of your business and its turnover: larger businesses with higher monthly or annual turnover will generally be offered lower rates.

- How long your business has been operating: the longer you’ve been in business (the age of your ABN) and GST-registered, the lower your rate is likely to be.

- Your business’ assets: businesses that have assets registered in their name, such as property, will benefit from lower rates than those without.

- Your business’ industry: different industries have different risk profiles. An established marketing firm is likely to be offered a different rate to a freighting company.

- Your business’ credit score: as is the case for almost all loans, credit score and history will play a major role in determining your interest rate.

Types of business loans in Australia

When it comes to the type of business loan you can apply for as an owner or operator in Australia, you’ll have a variety to choose from. While these loans are full doc as standard, there are also low doc options for each of them if you don’t have your full business financials.

Unsecured business loans

The most common and widely available type of business finance in Australia, unsecured loans are available for up to $300,000. You can take up to three years (or sometimes five) to repay your loan, but loans on the shorter side can come with terms as short as a couple of months.

Secured business loans

With a valuable business asset or property backing your loan, your borrowing power can extend into the millions of dollars. Securing your loan with an asset can also score you a lower interest rate and fees, as well as extend your repayment term up to 30 years in some cases.

Small business loans

Although this isn’t a specific product in itself, specialised commercial loans are available to small businesses for as little as $5,000. You can choose whether to secure your loan (if you have an eligible asset) and set your preferred repayment period.

Business lines of credit

An alternative to the standard business loan, lines of credit work in a similar way to credit cards. You’re approved for a set limit and can withdraw funds at any time up to that limit. There also aren’t any set repayments, but they may come with a maximum repayment period. Interest and fees are generally higher for these loans.

Business overdrafts

Like lines of credit, business overdrafts allow you to access funds up to an approved limit at any time and more or less repay them at your own speed. However, the difference here is that overdrafts are attached to business bank accounts. These allow you to withdraw beyond a $0 balance.

Invoice financing

Invoice financing can be one of two things. Invoice discounting involves receiving an advance on your outstanding invoices from a financier (up to 80 to 85%) and the remainder minus fees once the invoice is paid. Invoice factoring requires you to sell your outstanding invoices to a third party and receive up to 90% to 95% of their value.

Chattel mortgage

A chattel mortgage is a type of secured loan designed to help you purchase a commercial vehicle or equipment. The asset you buy acts as security for the loan. These can range from one to seven years in length with no set upper limit on your borrowing (up to what you can afford).

How long you’ll get to repay your business loan

"Most lenders will limit business loans to two to three years in length. Some lenders will do up to five years unsecured, but this is dependent on a range of factors, including turnover, the strength of your business and its longevity."

Why apply for a business loan with Savvy?

Expert brokers

You can speak with one of our specialist commercial brokers who can walk you through a range of loans to best suit your company's needs.

Over 40 lending partners

You can compare business loan offers, through a range of trusted lenders, maximising your chances of a great rate.

Fast online process

You can fill out our simple online form to generate a free business finance quote within minutes. You can also come back to it at any time.

How much will my business be able to borrow?

As you can see from the types listed above, different loans come with different borrowing ranges. However, each business is unique when it comes to its individual borrowing power. The key variables that can impact yours include:

- Your business’ revenue and expenses: the higher your business’ turnover, the more it’ll likely be able to borrow.

- Your business’ assets: owning property in particular can boost your business’ borrowing power significantly.

- Your business’ liabilities: of course, any outstanding debts or loans will eat into your available funds.

- Your business’ credit history: a strong track record of managing debts and similar loans in the past will help boost the amount you’re able to borrow.

- The value of your collateral (if secured): your collateral will need to be valuable enough to cover your loan, so this will also play a role in setting your business’ borrowing power.

You’ll be able to speak with one of our experienced consultants to find out how much your business can borrow. You can also crunch the numbers using our business loan calculator below to see how much you can afford in repayments.

Business loan calculator

Crunch the numbers to see what your repayments could look like

Your estimated repayments

$98.62

| Total interest paid: | Total amount to pay: |

| $1233.43 | $5,143.99 |

What to know before you apply for your business loan

"If you’re looking at an unsecured business loan of up to $250,000 to $300,000, lenders want to see that your statements are cashflow positive and that your account conduct is good. This means no dishonours or overdrawing, and no gambling or excessive cash withdrawals.

If you’re running a seasonal business, apply after a consistent six months of income. If you were to apply during a period of low business activity, you’d have a lower chance of a successful application and likely face an increase in interest rates."

How to apply for a business loan with Savvy

-

Apply online

Fill out our simple online application form.

-

Supply your docs

Send us any documents needed for profile verification.

-

Chat to your broker

We’ll give you a call to discuss your business’ options.

-

Prepared and submitted

Your broker will prepare your application for formal assessment.

-

Approved and settled

Once approved, simply sign the final documents and receive your loan!

Is it harder for small businesses to borrow money?

As mentioned, lenders consider a range of factors and criteria when it comes to assessing business loan applications. However, small businesses tend to face greater challenges in getting approved for the loan they want than larger, more established businesses. While it may be harder for some, that doesn’t mean it’s impossible.

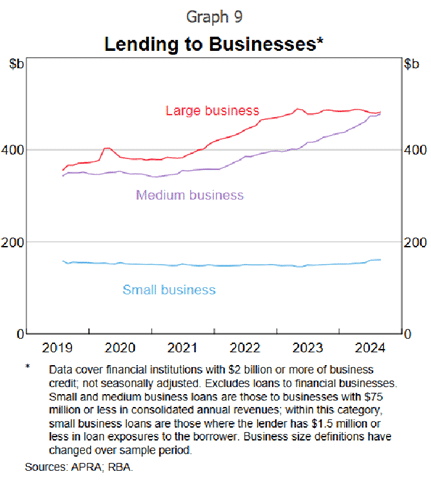

According to a report by the RBA, overall lending to SMEs increased by 12% in the year leading up to October 2024 and 25% from the start of 2022. It’s worth noting that, rather than an uptick in loans to small businesses, much of this growth is attributable to loans to medium businesses in agriculture, property services, retail and wholesale trade.

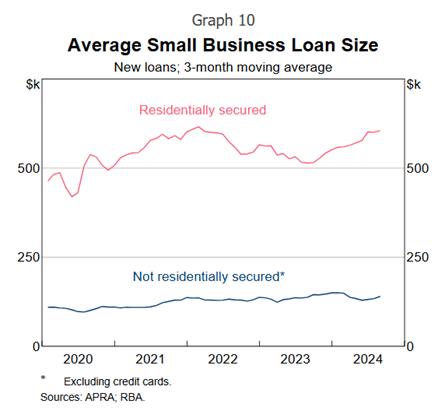

One simple way to improve your chances of loan approval as a small business owner is to use your residential property as collateral (if you have one). Almost half of all small business credit is secured by residential property. This is, of course, not without its risks, but the impact it has on the loans approved is clear: the average loan size rises from around $150,000 without property securing the loan to well over $500,000 with it.

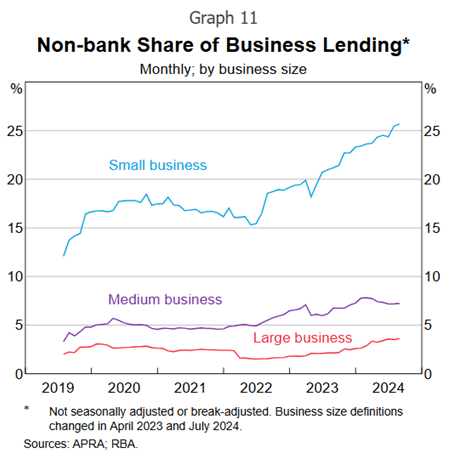

The other interesting takeaway from the RBA’s report is the rise in small business credit from non-bank lenders. This figure has jumped from just above 15% in mid-2022 to more than 25% by the end of 2024, which reflects not only a more aggressive pursuit of SMEs as business loan customers, but also companies seeking commercial brokers.

Business loan eligibility and documentation

Before you apply for your business loan, it’s important to know whether you meet your lender’s eligibility criteria and documentation requirements. Because these can differ slightly from lender to lender, your Savvy broker will compare the options suitable for your business from our panel of trusted Australian lending partners.

Eligibility

-

Age

You must be at least 18 years of age.

-

Residency

You must be an Australian citizen or permanent resident (or, in some cases, an eligible visa holder).

-

ABN registration

Have an ABN registered in your name (available from as soon as one day after registration).

-

Usage

Meet business usage requirements (at least 51% of any asset you buy, for example).

-

Credit score

You must meet your lender’s minimum personal and business credit score requirements.

-

Commercial asset

If you're buying an asset with a secured loan, it must meet your lender’s requirements in relation to its type, age and condition.

Documents

-

Personal information

Such as your full name, date of birth, address and contact details.

-

Driver's licence

Front and back (or another form of government-issued ID).

-

Assets and liabilities

Information about your business’ assets and liabilities, as well as those in your name.

-

Asset details

If buying an asset, information such as its model and age is worthwhile having on hand.

-

Business Activity Statements (BAS)

Lenders will want to see your BAS, as well as the running balance of GST and tax payable for your business.

-

Other business financials

You’ll usually have to provide completed financials for the previous financial year, which may include three to six months of bank statements, a copy of a trust deed and any applicable amendments.

When it comes to low doc loans, you won’t need to hit all the same marks as full doc. Things like proof of income and BAS aren’t required for this type of finance, opening doors for businesses who might not have all the info to qualify for a standard commercial loan.

Business lenders you can compare

- Small Business Economic and Financial Conditions - Reserve Bank of Australia

- Interest and transaction expenses to buy items for work - Australian Taxation Office

- Agile Market Intelligence’s 2025 Third-Party Lending Report - Broker Pulse