A new survey into Christmas spending has revealed that Australians will still be investing a substantial amount this year, despite inflation and rising cost of living expenses.

- Australians will spend up to $14.9 billion this Christmas

- This Christmas, the average Aussie will spend $767

- The average woman will spend $848 at Christmas, in contrast to the average male spend of $705

- 76% of shoppers plan to primarily fund their spending with their savings

Australians are set to spend big for Christmas this year, with an expected $14.9 billion to be dropped in 2022, a new survey commissioned by Savvy has revealed.

This means that the average Australian adult will spend $767 for Christmas, with women set to spend $848 and men an average of $705.

How much will Australians be spending on Christmas in 2022?

The representative demographic sample of 1,000 adults shows that the total amount spent by Australians this Christmas could reach as high as $14.9 billion (which encompasses gifts, food and drinks and travel), setting the average spend per person at $767.

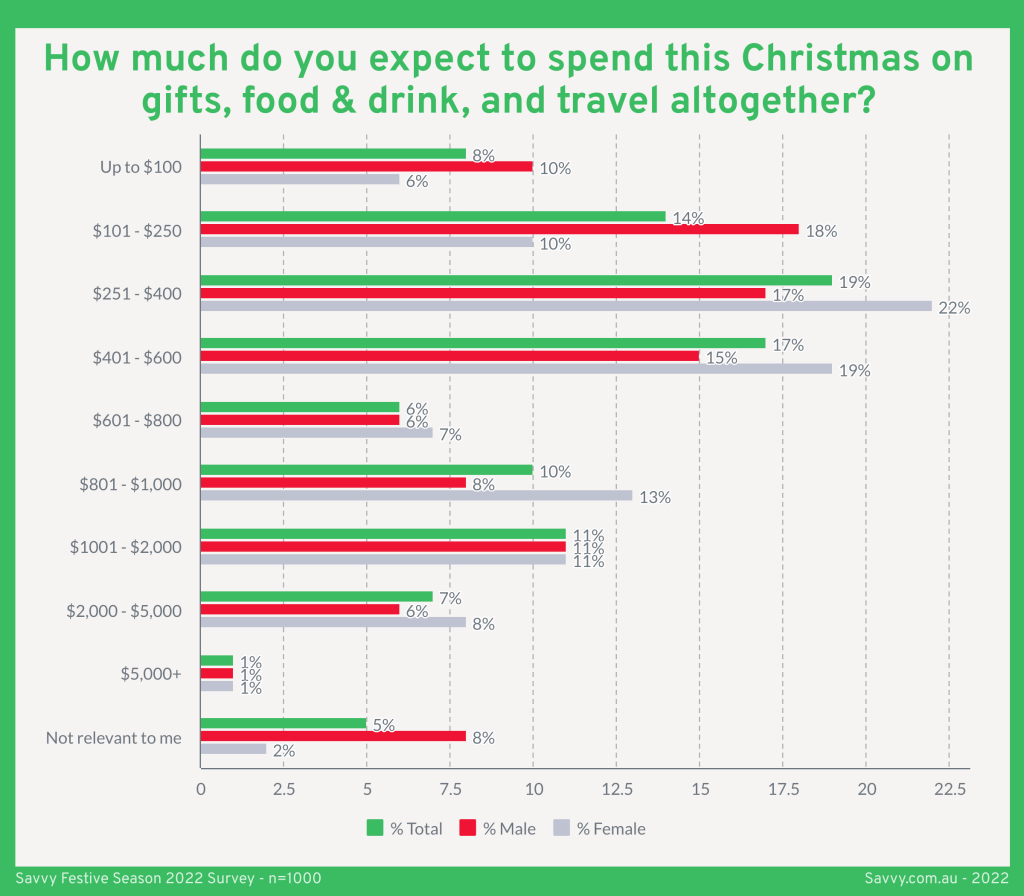

The data from this survey shows that 50% of Australians plan to spend between $100 and $600 this Christmas, while 19% are intending to invest over $1,000. Only 8% of shoppers will put $100 or less towards their Christmas spending this year.

Those in the 35 to 54-year age bracket are set to be the biggest spenders, with 27% of 35 to 44-year-olds and 25% of 45 to 54-year-olds planning to spend more than $1,000. In comparison, only 16% of 25 to 34-year-olds and 11% of 18 to 24-year-olds are looking to splash that amount.

However, a recent survey commissioned by Savvy into Black Friday shopping revealed that 51% of Australians planned to spend less this festive season in comparison to 2021.

Women the bigger spenders compared to men

The survey also revealed that women are likely to spend significantly more than men, with the average female shopper set to spend up to $848 this Christmas in comparison to the average male, who may only spend $705.

28% of Australian men plan to spend $250 or less for the holiday, which is notably higher than the 16% of women who are looking to do the same.

41% of women intend to drop between $250 and $600 on presents and other festive expenses, while the number of men spending within the same bracket sits at only 32%.

How are Australians planning to fund their Christmas purchases?

The majority of Australians will be primarily funding their Christmas spending with their savings, with 76% stating they would mainly be utilising their own money to do so. This is up 5% on 2021, where 71% said they would rely on savings.

However, the number of Australians who plan to use either a credit card or buy now, pay later (BNPL) service as a main source of funding for their Christmas shopping has increased, with credit cards rising from 16% to 28% and BNPL from 6% to 17%.

How will rising living expenses and inflation impact the festive season?

This Christmas comes against the backdrop of rapid inflation and rising cost of living, which is the main reason why many families are spending less this festive season.

As reported in Savvy’s Black Friday shopping survey, 67% of Australians stated that the current financial situation in Australia would either negatively or significantly negatively impact their holiday period.

Many Aussies set for a bumper Christmas period– expert

Savvy spokesperson Adrian Edlington says that the results of the survey indicate that although inflation and cost of living expenses are impacting Australian budgets, families are still investing hundreds or thousands over Christmas.

Savvy Spokesperson, Bill Tsouvalas;

“Our survey shows that Australians are still keen to spend over the Christmas season, with the average spend of over $750 per person potentially leading to almost $15 billion being invested back into our economy.

“Although this year has been difficult for many families around the country, Christmas remains a time of hope and optimism, so it’s heartening to see that people will still be able to buy presents for their friends and family and travel across the end of the year.

“Most Australians are still using their savings, but more are now turning to credit cards and BNPL services. It’s important to avoid taking out too much credit over Christmas, as avoiding excessive and unmanageable debts will significantly reduce your chances of experiencing January stress. As always, we advocate debt consolidation and use of personal loans when it is necessary to borrow, which consistently deliver significantly better interest rates and conditions than the others.”

Methodology

Savvy, Festive Season 2022 survey, (n=1000)

Nationally representative survey of 1000 adult Australians, aged 18 and over. Conducted by Octopus Group, on behalf of Savvy.

Completion date: 1/12/2021

Age groups:18-24, 25-34, 35-44, 45-54, 55-64, 65+

Gender breakdown: male n=503, female n=495, non-binary /prefer not to say n=2

Representative of state and territory populations:

NSW n=299 (32.3%), Vic n=253 (25.1%), Qld n=196 (20.2%), SA n=82 (7.2%), WA n=114 (10.6%) NT n=12 (0.7%), Tas n=12 (2.2%), ACT n=19 (1.7%)