Savvy breaks down the key stats on superannuation in Australia for men and women of different age groups.

- 44% of men currently have a superannuation balance of more than $100,000, compared to just 24% of women

- 45% of women currently have a superannuation balance of $50,000 or less, in contrast to 32% of men

- 52% of Australians between 45 and 54 years old feel either unconfident or not confident at all in having enough in their super by the age of 65

- 57% of Australians currently do not make any additional contributions to their superannuation

A new survey commissioned by Savvy has revealed that only 24% of Australian women currently have a superannuation account balance of over $100,000, compared to 44% of men.

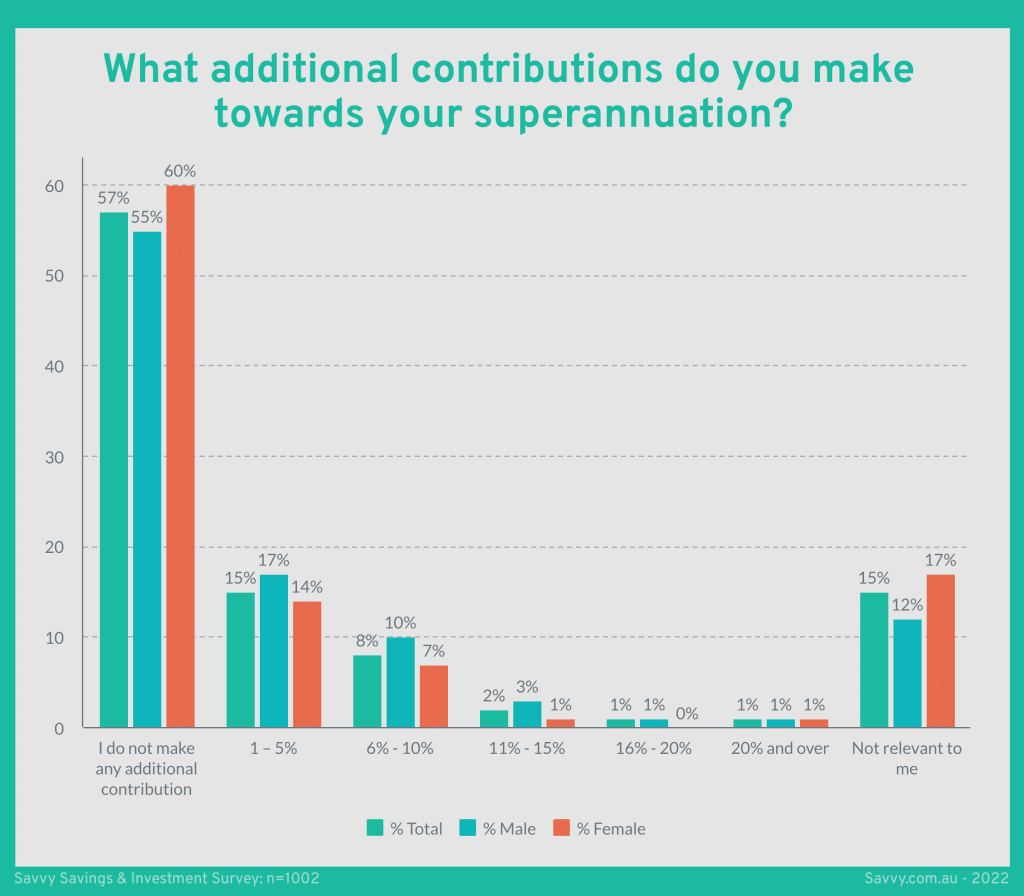

Digging deeper into the statistics shows that 45% of women have a super balance of $50,000 or less, in contrast to 32% of men in the same boat. Additionally, 60% of women make no additional superannuation contributions, which is higher than the 55% of Australian men who do so.

Average Australian's superannuation balance

In terms of current superannuation balance, the representative demographic sample of Australian adults (n=1,002) showed that women are more likely to have a lower amount saved in their account and, crucially, much less likely to have a high amount saved.

19% of women currently have a superannuation balance of $10,000 or less, in comparison to 13% of men.

16% of men have between $200,001 and $400,000 in their super, which is notably higher than the 9% of women within the same bracket.

7% of Australian men have a balance of between $400,001 and $700,000 compared to 4% of women, while men were also higher in the $700,001 to $1 million (4% to 1%) and $1 million and over (3% to 1%) brackets.

Analysing the differences between age groups shows that 18 to 24-year-olds represent the largest demographic with a balance of $10,000 or less at 55%, followed by 25 to 34-year-olds (16%) and 35 to 44-year-olds (13%).

Only 12% of 25 to 34-year-olds have a balance above $100,000, in comparison to 39% of 35 to 44-year-olds, 57% of 45 to 54-year-olds, 65% of 55 to 64-year-olds and 33% of those 65 and over.

Interestingly, the survey found that 12% of Australians currently have no super at all, with those 65 and over (31%) and 55 to 64-year-olds (15%) making up the largest portion of this figure.

Super contributions low among Australians

Regarding additional super contributions made by Australians, over half of all adults make no voluntary payments into their account, totalling 57%.

This is most prevalent amongst 25 to 34-year-olds, with 67% not making any additional contributions, followed by 18 to 24-year-olds (64%) and 35 to 44-year-olds (63%).

15% of Australians pay an added 1 – 5% of their income into their super, while 8% contribute 6 – 10%. Only 4% of adults deposit more than 10% of their income into their super.

The survey results also show that men contribute more across the board, with 17% contributing 1 – 5% compared to 14% of women, 10% paying 6 – 10% compared to 7% and 6% paying more than 10% in contrast to 2% of women.

Confidence in sufficient super balance low among older Australians

52% of Australians in the 45 to 54-year-old age bracket feel either unconfident or not confident at all that they’ll have enough in their super account by the age of 65, with 40% of those between 55 and 64 in the same camp.

39% of 25 to 34-year-olds and 41% of 35 to 44-year-olds also lacked confidence on some level of having the funds they need at 65. Only 26% of 35 to 44-year-olds were confident or very confident, while just 28% of 45 to 54-year-olds felt the same way.

By contrast, those in the 18 to 24-year-old age bracket remain the most confident overall in having enough money saved by the age of 65. 43% considered themselves either confident or very confident in having sufficient funds by that stage of their lives, with only 24% feeling unconfident or not confident at all.

When dividing the numbers by gender, 38% of men felt either confident or very confident that they’d have enough saved, compared to 25% of women. While 35% of men felt either unconfident or not confident at all, this percentage increased to 44% for women.

Super a sign of the times – expert

Money expert, Adrian Edlington says that current super balances and confidence among Australians are representative of wider social and economic issues in the country.

Savvy Spokesperson, Adrian Edlington;

“Our survey highlighted that the clear issues relating to the difference in pay between men and women in Australia are being felt not only in terms of savings but also superannuation and setting up for the future.”

“Nearly half of all adult women in Australia currently have $50,000 or less in their account, while the number of men who have $100,000 or more in their super is almost double that of women.”

“This is a clear symptom of the gender pay gap, which currently sits at more than 14%. Women in Australia earn $263.90 per week less than men, a disparity which can put acute pressure on them in times of aggressive inflation and interest rate rises.”

“The current financial climate may also contribute to the general lack of confidence in super savings being enough for retirement, with over half of all Australians aged between 45 and 54 now feeling that there may not be a sufficient amount in their account by the age of 65.”

“Additionally, with Savvy finding that 57% of Australians make no voluntary contributions, it’s clear that more needs to be done to educate adults (particularly those between the ages of 18 and 44) to grow their super so they can more comfortably set themselves up for retirement.”

What is superannuation and how does it work?

Superannuation (commonly known as super) in Australia is the funds put aside and saved up for your retirement. The way this works is by your employer paying a certain percentage of your salary or wage into your super with each payslip.

Your super grows over time due to ongoing deposits from your employment earnings and via investments by your super provider. They invest the funds provided by you and other Australians in different areas to further boost your balance, doing so in a variety of areas such as shares, fixed interest, property and other assets.

| Superannuation Preservation Age: (age at which you will be able to access savings) | |||

|---|---|---|---|

| Born before 1 July 1960: | preservation age of 55 years | ||

| 1 July 1960 to 30 June 1961: | 56 | ||

| 1 July 1961 to 30 June 1962: | 57 | ||

| 1 July 1962 to 30 June 1963: | 58 | ||

| 1 July 1963 to 30 June 1964: | 59 | ||

| On or after 1 July 1964: | 60 | ||

You’ll be able to access your super when you reach your preservation age, after which you can choose to have the funds paid out in a lump sum or as an ongoing income stream. Your preservation age depends on the year you were born, as seen here.

However, there are other situations where you may be able to withdraw from your super, such as if you’re suffering from a terminal illness, temporary or permanent incapacity or experiencing financial hardship. The first home super saver scheme also allows those who are buying a house to access up to $30,000 worth of voluntary contributions to be put towards a deposit.

What is the superannuation guarantee?

The superannuation guarantee (or SG) is the percentage of your earnings which your employer is required to pay into your super on each payslip. If you’re 18 years of age or older (or under 18 and working 30 hours per week or more), you’re entitled to receive super payments from your employer.

The current SG rate in Australia is 10.5% of your standard earnings, but this percentage is set to increase by 0.5% each financial year until reaching 12% in the 2025-26 year. The SG is a crucial part of super earnings, as it helps ensure your savings are constantly growing.

What is a Unique Superannuation Identifier and how do I find mine?

A Unique Superannuation Identifier (USI) is a number which distinguishes between super funds and individual super products. This is primarily required for making contributions or rolling over multiple funds into the same account.

In terms of how to find your fund’s USI, you can search the ATO’s USI and SPIN Lookup function. You should also be able to find it by searching on your super fund’s website or your annual statement.

How much superannuation should I have?

The amount you should have in your super by the time you retire will differ from person to person, as everyone has different living requirements and expenses. However, according to the Association of Superannuation Funds of Australia (AFSA), the figure for a comfortable retirement is around $545,000 for singles and $640,000 for couples. However, as of March 2022, the average super balances by age were as seen here:

| Average Amount of Superannuation at Given Agebrackets | |||

|---|---|---|---|

| Age | Men | Women | |

| 18 to 24 | $8,072 | $6,994 | |

| 25 to 29 | $25,173 | $21,774 | |

| 30 to 34 | $51,175 | $42,240 | |

| 35 to 39 | $83,723 | $66,611 | |

| 40 to 44 | $121,119 | $92,680 | |

| 45 to 49 | $165,587 | $112,228 | |

| 50 to 54 | $214,795 | $157,124 | |

| 55 to 59 | $286,283 | $209,653 | |

| 60 to 64 | $359,870 | $289,179 | |

How do I find lost super and consolidate it?

Finding your lost super is simpler than you might think, as all you’ll have to do is link your myGov account to the ATO (if you haven’t already). This will enable you to see any super in your name and consolidate it into a single account.

If you’ve changed super funds throughout your working life and lost some of your funds (which may happen for any number of reasons such as switching jobs, moving house or changing your name), it’s important to get them back and consolidate them into one account. Having more than one account means you’ll likely be paying more in fees than you need to be, so it’s valuable to combine them as soon as possible.